![]()

ISSN 2379-5980 (online) DOI 10.5195/LEDGER.2024.326

An Invitational Research Article from the ChainScience 2023 Conference

The Four Types of Stablecoins: A Comparative Analysis

Matthias Hafner,∗ Marco Henriques Pereira,† Helmut Dietl,‡ Juan Beccuti§

![]()

∗ M. Hafner (matthias@cryptecon.org) is Director at the Center for Cryptoeconomics and Principal at Swiss Economics, Switzerland.

† M. Henriques Pereira (corresponding author: marco.pereira@business.uzh.ch) is a Postdoctoral Researcher at the University of Zurich, Switzerland.

‡ H. Dietl (helmut.dietl@business.uzh.ch) is Professor for Services & Operations Management at the University of Zurich, Switzerland.

§ J. Beccuti (juanbeccuti@gmail.com) is Economics Researcher at Informal Systems, Canada.

![]()

Stablecoins, a type of cryptocurrency designed to maintain a stable value relative to a particular asset or group of assets, have experienced tremendous growth in recent years.1, 2 The increasing demand for stablecoins has led to a surge in the number of stablecoins available, and the market cap for stablecoins has risen to over $180 billion in just a few years.3

However, recent events such as the crash of TerraUSD and the de-pegging of USDC have raised questions about the stability of stablecoins.4 As a result, there is a growing need for a better understanding of how stable these coins actually are and the differences between various types of stablecoins.5 Furthermore, the rapid growth and questions about stability have raised concerns among regulators, and there is currently ongoing discussion about how to regulate stablecoins.6 As there is still limited knowledge about stablecoins, this has become a crucial area of research.

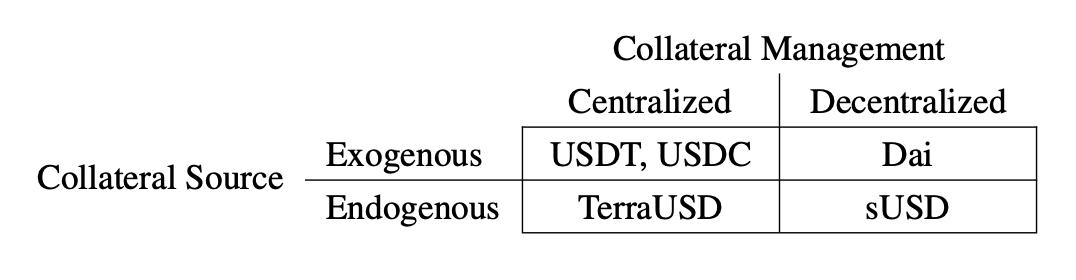

This paper proposes a novel categorization of stablecoins and investigates the stability of each type under different conditions. Our categorization is based on two key dimensions, resulting in a 2 × 2 matrix that classifies stablecoins into four types. The first dimension pertains to the source of collateral, i.e., whether it comes from an exogenous source (such as fiat money and gold reserves) or an endogenous source (such as crypto assets like sUSD and TerraUSD). The second dimension pertains to the management of collateral, i.e., whether a central entity or mechanism manages pooled collateral and decides when to expand or contract supply, or whether individuals manage their collateral “decentrally” (i.e., in a decentralized way) and mint and burn stablecoins to adjust supply. This categorization provides an economical and comprehensive way to classify stablecoins.

To assess the stability of each stablecoin type, we adopt an agent-based modeling approach and simulate each category. By varying different parameters and conditions in the simulations, we aim to identify the circumstances under which each type of stablecoin is stable and not stable. The study highlights potential risks associated with stablecoins with endogenous and centrally managed collateral, as they may be at a higher risk of crashing after a demand shock. A sudden surge in demand can trigger a death spiral, as seen in the TerraUSD crash. Moreover, our study shows that centralized collateral management may pose a greater risk of a bank run than decentralized collateral management because users may withdraw their funds en masse, leading to a collapse in the stablecoins’ value. Therefore, on one hand, stablecoins with exogenous and decentrally managed collateral, like Dai, may be considered the safest choice. On the other hand, stablecoins with endogenous and decentrally managed collateral, such as sUSD, provide greater autonomy and independence. However, these two designs also come at a cost: without additional measures, Dai and sUSD are more costly to create and experience stronger fluctuations around their peg than others. Ultimately, we conclude that the choice between different types of stablecoins depends on individual risk preferences and specific use cases and that a trilemma exists between stability, independence, and costs.

Our study emphasizes the importance of carefully evaluating the source of a stablecoin’s collateral and its collateral management mechanism to ensure stability and minimize risks. Additionally, policymakers should exercise caution when dealing with stablecoins, such as TerraUSD, that have endogenous and centrally managed collateral. To protect users and mitigate systemic risks in the financial system, it is crucial for policymakers to take steps to ensure the stability of these stablecoins through appropriate regulations. However, stablecoins that use a combination of endogenous and decentrally managed collateral, such as sUSD, have proven stable and reliable. Therefore, regulators should carefully consider both dimensions when crafting policies rather than imposing overly restrictive measures on all stablecoins with endogenous collateral.

State of the Literature—The most common categorization of stablecoins is based on the type of collateral. This classification typically yields three distinct types of stablecoins: fiat-collateralized, cryptocurrency-collateralized, and non-collateralized (or algorithmic).7–13 Aloui et al. (2021) propose the concept of commodity-based stablecoins, such as those backed by gold,14 so commodity-collateralized constitutes a fourth type.15 However, the literature utilizing this type of categorization often emphasizes the aspects of trust and decentralization instead of the stability of stablecoins.

Another approach categorizes stablecoins as either custodial or non-custodial.16 Custodial stablecoins depend on an issuer to hold reserves off-chain, whereas non-custodial stablecoins leverage smart contracts to establish a risk transfer market on the blockchain.

Bullmann et al. (2019) classify stablecoins with three dimensions: the presence or absence of an issuer responsible for fulfilling associated claims, the degree of decentralization of responsibilities in the stablecoin initiative, and the underlying value supporting stability of the stablecoin (source of value).1 Their approach allows us to classify any token within a 3 × 3 cube and has been utilized in other literature as well.2 While the dimension “source of value” has a strong economic impact on price stability, the remaining two dimensions are less crucial in terms of an economic categorization.

Moin et al. (2020) identify four dimensions of stablecoins without providing a classification scheme as such.17 The dimensions are type of collateral, stability mechanism (e.g., reserve or dual coin), method for determining the price of the pegged asset (e.g., oracle, voting, trading), and peg used (e.g., pegged to fiat, a commodity, or a financial asset).

Finally, Klages-Mundt et al. (2020) and Klages-Mundt and Minca (2022) utilize the dimensions of custodial/non-custodial stablecoins and source of value.18, 19 The source of value dimension is essential when examining stablecoin stability from an economic perspective, as exogenous vs. endogenous backing can have vastly different consequences, as we shall see.

New 2 × 2 Matrix—We add to the above classifications something new: a generalized, 2 x 2 matrix classification of stablecoins with a strong focus on economic principles (Table 1). As the collateral drives the value of a stablecoin, we focus on the collateral in defining the dimensions collateral source and collateral management. Our categorization is based on the underlying economic characteristics of stablecoins, rather than on their precise operational mechanisms. Despite the existence of considerable diversity in design, the two economic dimensions identified in our categorization can be applied to all stablecoins.

Table 1. 2 × 2 matrix for categorizing stablecoins with examples of each type. Whitepapers and citations for the examples given can be found in the endnotes.20–24

The first dimension is collateral source, derived from the “source of value” already used by Bullmann and Klages-Mundt, which can be exogenous, such as fiat and gold held in reserve, or endogenous,25 in other words, a crypto asset of the same ecosystem.26 The second dimension is collateral management, which can be centralized entities and mechanisms managing pooled collateral, or individuals managing their collateral decentrally.27 The key point here is that to be centralized, an entity (or protocol) issues the stablecoin and also provides collateral (thus the entity ensures stability), whereas to be decentralized, anyone can issue the stablecoin and is also responsible for providing collateral (thus the decentralized nature of the stablecoin design ensures stability). Note the collateral management dimension differs from the custodial/non-custodial dimension as it centers on the issuer of stablecoins, i.e., who owns and manages the collateral, rather than the mode of issuance, whether through a central entity or a smart contract. These two dimensions are complementary, and our 2 × 2 matrix could be expanded to a 3 × 3 cube by including the custodial/non-custodial dimension. For the purpose of this paper, however, we will stick with the 2 × 2 matrix.

The matrix is applicable to any currency, on or off-chain. Appendix A shows the distinctions between the two stablecoin dimensions. However, certain exceptions exist within our stablecoin categorization framework. For example, USDD combines collateral sources that are both exogenous and endogenous, placing it between two categories.28 Additionally, some assets like AMPL do not fit our definition of a stablecoin, as they fail to maintain a stable wallet value for its users as quantities vary over time due to rebasement.29 Or in other words, the value of a portfolio AMPL fluctuates over time, where it does not for stablecoins.

Despite the difficulty of predicting exact trajectories of stablecoin values, simulations can be a valuable tool to enhance our comprehension of the mechanisms behind the four types of stablecoins and to examine their stability conditions. Yet, our results should be analyzed and interpreted cautiously, keeping in mind that the model was not intended to perfectly replicate any particular real-world stablecoin but rather to illustrate differences in stablecoin design and response to shocks. An agent-based simulation approach is a suitable simulation method for testing stablecoin stability because it can produce a wide variety of unpredictable behavior with detail.30

In this Monte Carlo experiment, the agents are users who seek the stablecoin for non-volatile blockchain-based payments, investors who buy and sell the stablecoin to earn fees,31 and issuers who issue the stablecoin in exchange for collateral. Issuers differ with respect to collateral management. Under centralized collateral management, the issuer issues the stablecoin against collateral provided by the investor and then centrally manages the stablecoin. Under decentralized collateral management, a protocol enables the investor to independently issue the stablecoin. Under decentralized management, each investor can have one or more individual central-debt positions; the protocol intervenes only if the position is at risk of becoming under-collateralized.

Initially, the model sets up the parameters used for the price calculation of the endogenous or exogenous collateral as well as the initial wallets of the agents. Each wallet includes fiat money (in USD), stablecoins (valued in USD), and collateral (also valued in USD). The investors’ wallets are initialized with higher amounts than users’ to ensure a realistic representation. The model also sets up the number of paths and time steps.

The stablecoin demand of the investors heavily depends on users’ demand, and the investors adjust their demand accordingly. User demand in time step t is calculated as follows:

| \(\begin{equation} D_t(user) = \left\{\begin{array}{lr} (a - b \cdot fees + d \cdot s_t + r_t \cdot m), & \text{if } o_t \geq 1\\ (a - b \cdot fees + d \cdot s_t + r_t \cdot m) \cdot o_t^2, & \text{if } o_{crit} \leq o_t < 1\\ 0 & \text{if } o_t < o_{crit} \end{array}\right\} \end{equation}\) | $$(1)$$ |

Variables a, b, and d represent parameters used to calibrate the model. Investors charge users fees for trading with the stablecoin. A dummy variable \(s_t\) indicates whether demand includes an exogenous shock.32 Variable r is a parameter that controls randomness in the system, while m represents the magnitude of randomness. The collateral level of the stablecoin (i.e., the value of collateral divided by number of stablecoins) is described by o. If collateral level \(o_t\) hits a critical level (\(o_{crit}\)), demand is assumed to be zero.4 The simulation is carried out over t time steps.

Investor overall demand equals users’ demand plus a liquidity margin (l). In time step t it is calculated as follows:

| \(\begin{equation} D_t(investor) = l + D_t(user) \end{equation}\) | $$(2)$$ |

Investors then create or burn stablecoins depending on the difference between their own holdings and their demand for stablecoins (\(D_t(investors)\)).

We simulated a sequence of time steps for each path and modeled three different scenarios:

[1] Baseline: No shock in user demand.

[2] Negative: A significant negative demand shock at a specific time step.

[3] Positive: A significant positive demand shock at a specific time step.

At each time step, a nine-step sequence of events occurs. First, the model updates the price of the stablecoin. The stablecoin price \(P(s)\) at time step t is calculated using the simple formula

| \(\begin{equation} P_t(s) = D_t(s)/S_t(s) \end{equation}\) | $$(3)$$ |

Where \(D_t(s)\) is the total demand, constituting the aggregate of user and investor demand, and \(S_t(s)\) denotes the supply of the stablecoin, which refers to the quantity of stablecoins currently in circulation.

Second, the model calculates the price of the collateral. The price calculation differs depending on source. For stablecoin types like USDT and Dai, the collateral source is exogenous, and price is calculated using geometric Brownian motion:

| \(\begin{equation} P_t(C_e) = P_0(C_e) \cdot \exp((\mu - 0.5 \cdot \sigma^2) \cdot t + \sigma \cdot W_t) \end{equation}\) | $$(4)$$ |

\(P_0(C_e)\) is the initial price of the (exogenous) collateral, \(\mu\) is the expected return, and \(\sigma\) is the volatility of collateral. \(W_t\)is the standard Brownian motion process.

For stablecoin types like TerraUSD and sUSD, the collateral source is endogenous. We calculate its fair price considering that the collateral is in the same ecosystem as the stablecoin and holders/stakers of it receive (a share of) the trading revenues:

| \(\begin{equation} P_t(C_i) = e \cdot (((D_t(user) \cdot fees)/z)/S_t(C_i))/c \end{equation}\) | $$(5)$$ |

In (5), e represents a parameter used to calibrate the model; users are charged fees by investors for users trading with the stablecoin (see also Eq. 1); z represents a perpetual interest rate, while c represents the opportunity costs, i.e., the return of an alternative investment option; \(S_t(C_i)\) is the circulating supply of the (endogenous) collateral.

Third, the model calculates the stablecoin demand of the users (Eq. 1) and, fourth, of the investors (Eq. 2).

Fifth, the model calculates the staking demand of the investor.33 When considering staking, investors compare the returns on staking with other investment options. If the returns on staking increase—which is determined by stablecoin demand and stablecoin fees—staking becomes more appealing, and vice versa. We obtain the staking demand by solving for the amount of staking that makes investors indifferent to staking or not:

| \(\begin{equation} D_t(staking) = f + g \cdot(D_t(user) \cdot fees)/c) \end{equation} \) | $$(6)$$ |

In Equation 6, f and g represent parameters used to calibrate the model.34 Because the investors of stablecoin types with decentralized collateral management can stake their endogenous collateral to receive stablecoins, this step applies only to stablecoin types with decentralized collateral management, such as Dai and sUSD, and not to types like USDT and TerraUSD. In the sixth, seventh, and eighth steps, the model simulates the actions of the agents. In the sixth step, in the case of centralized collateral management, if investor demand increases, investors buy stablecoins from the issuer. If investor demand decreases, investors sell stablecoins to the issuer. Investors pay a transaction fee for buying and selling to issuers. In the case of decentralized collateral management, if investor demand increases, investors use the issuer protocol to issue central-debt positions by depositing collateral in at least the desired amount of stablecoins times the collateral ratio, allowing investors to issue stablecoins directly themselves. If investor demand decreases, investors use the issuer protocol to resolve central-debt positions.

Seventh, investors trade stablecoins with users based on user demand. If user demand increases compared to the previous time step, users buy stablecoins from investors, and if user demand decreases, users sell stablecoins to investors. In both cases, users pay a transaction fee to investors.

Eighth, if staking demand increased, investors stake additional collateral to receive stablecoins. If staking demand decreased, investors resolve some central-debt positions. This step applies only to stablecoin types with decentralized collateral management, such as Dai or sUSD, and not to stablecoin types like USDT or TerraUSD.

Ninth, after each time step, the model saves all calculated values and updates each agent’s wallet as well as the supply and price of each asset.

The second, fifth, sixth and eighth steps demonstrate the differences between the two dimensions of our 2 × 2 matrix, collateral source and collateral management. These steps involve calculations or actions that depend on one or both dimensions. Appendix B illustrates the algorithm of the agent-based model step-by-step. Moreover, Appendix C explains the three control mechanisms incorporated in the model.

Our results show that all four stablecoin types remain stable: in the absence of any demand shocks, they keep their peg. However, the types react differently after a significant negative demand shock; some even collapse. Decentralized stablecoins appear more resilient to bank runs than centralized stablecoins. Stability, independence, and costs constitute a trilemma.

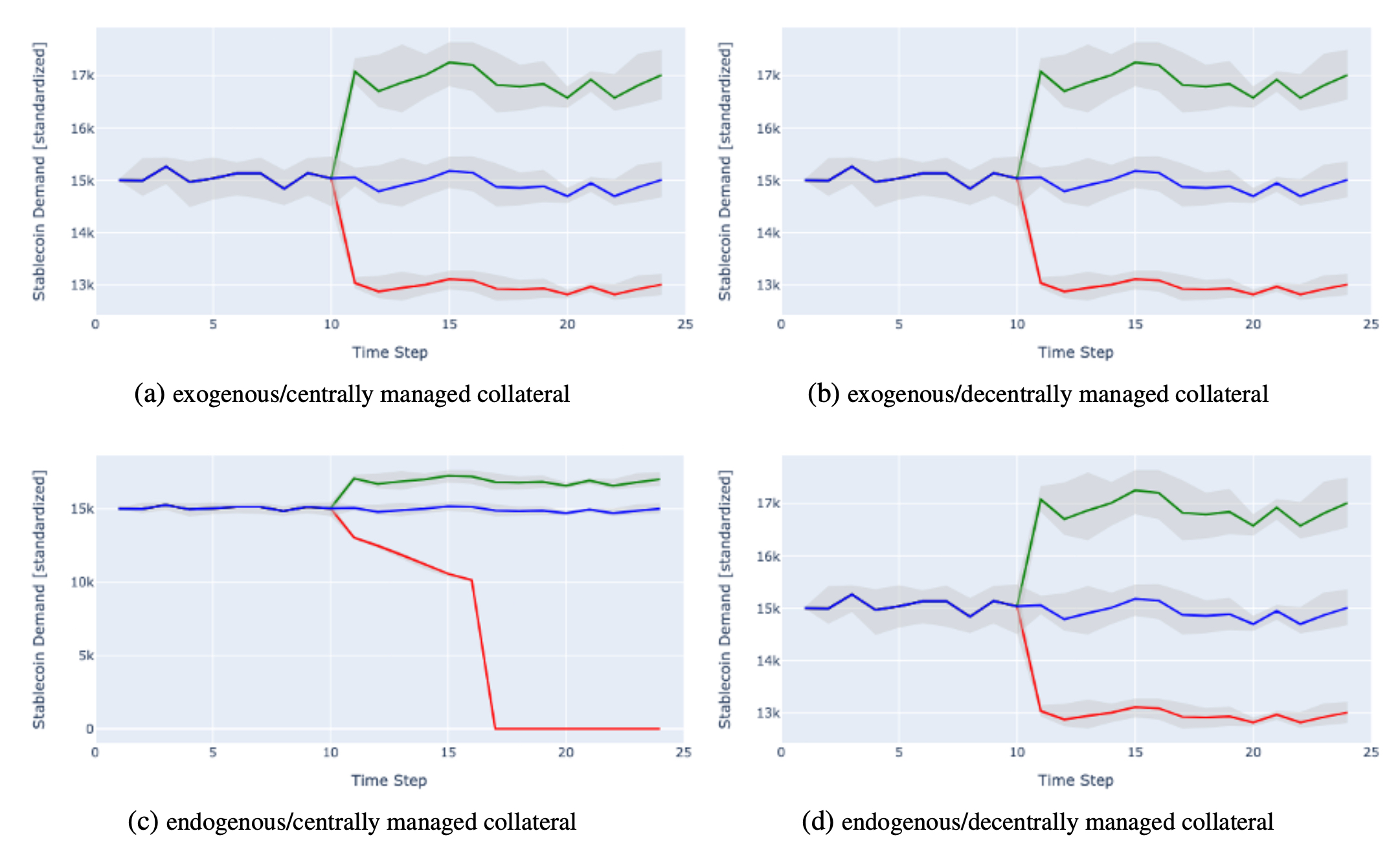

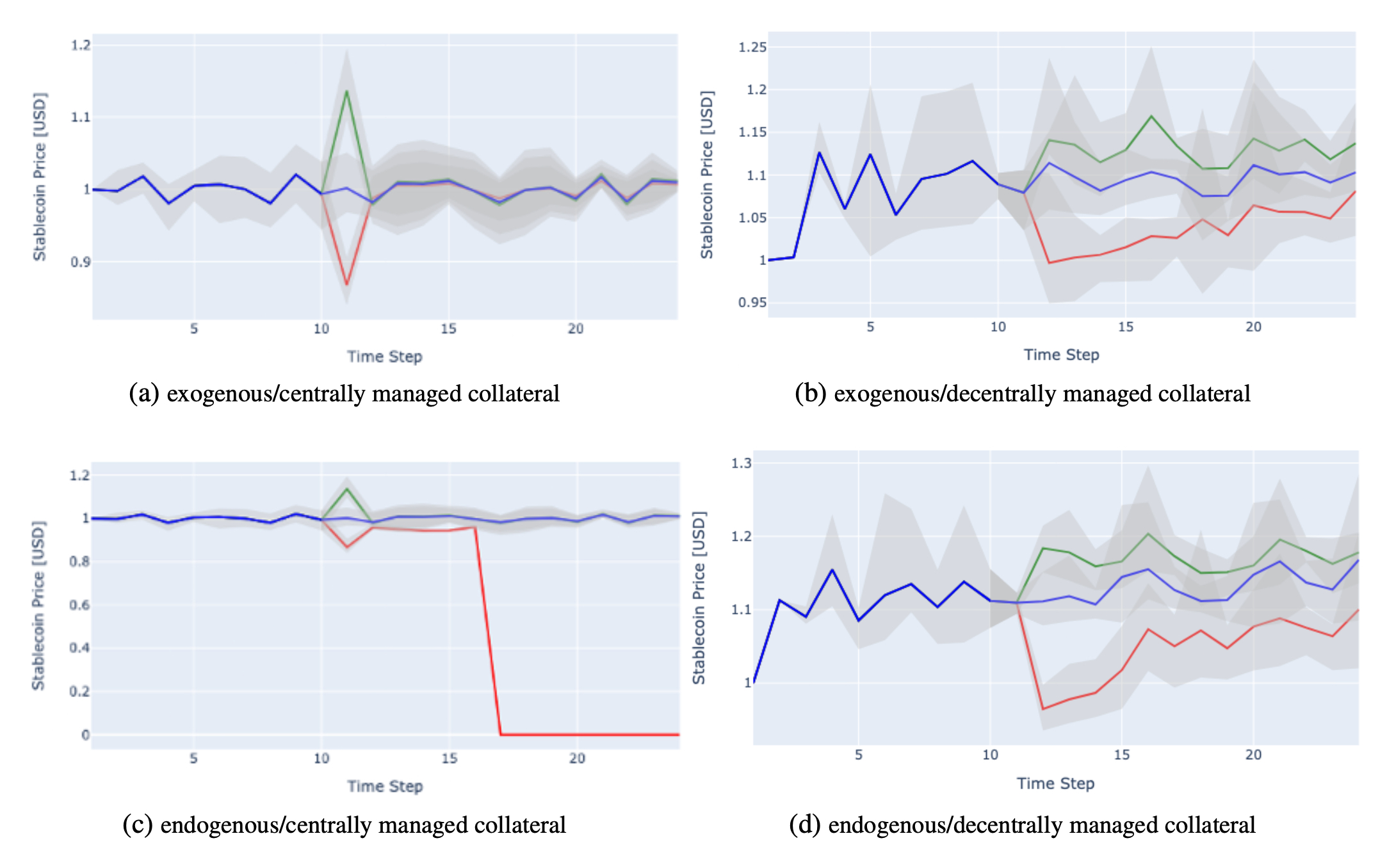

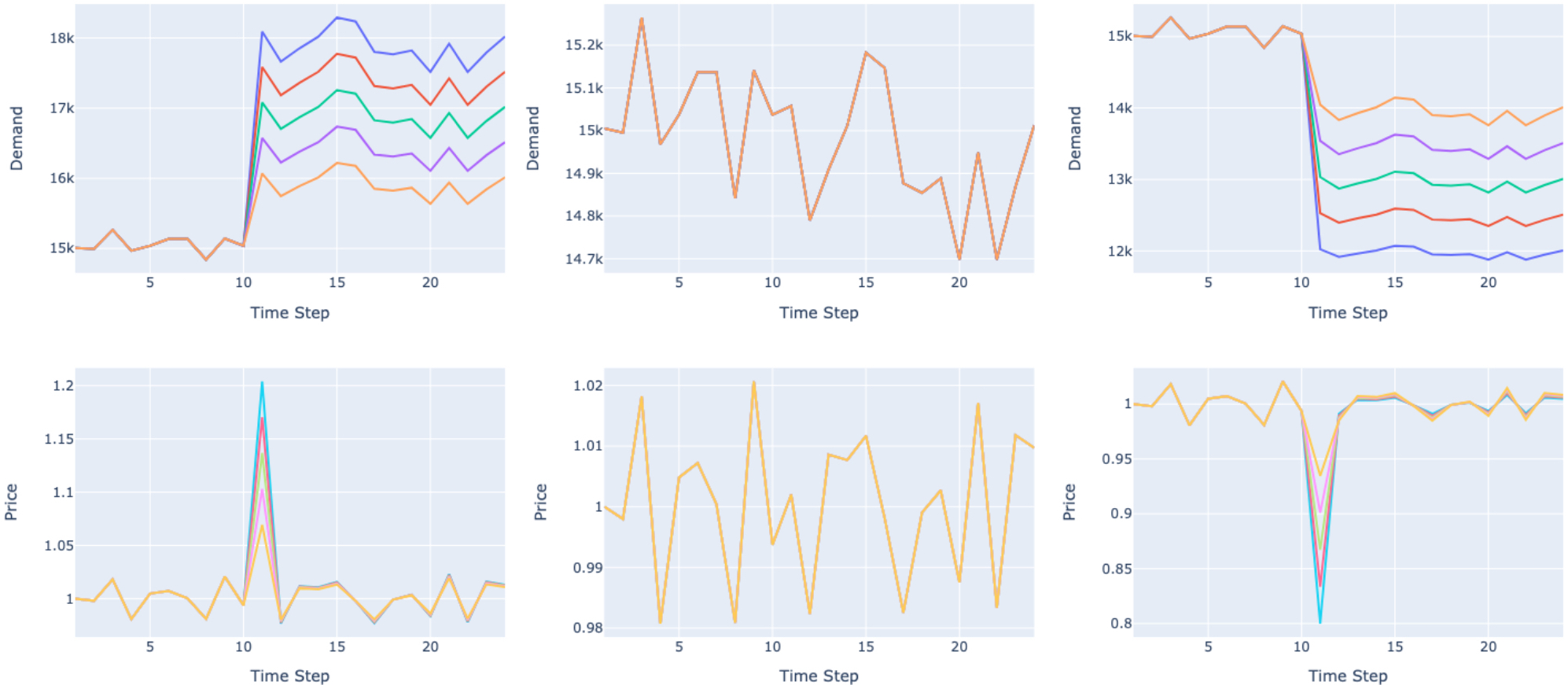

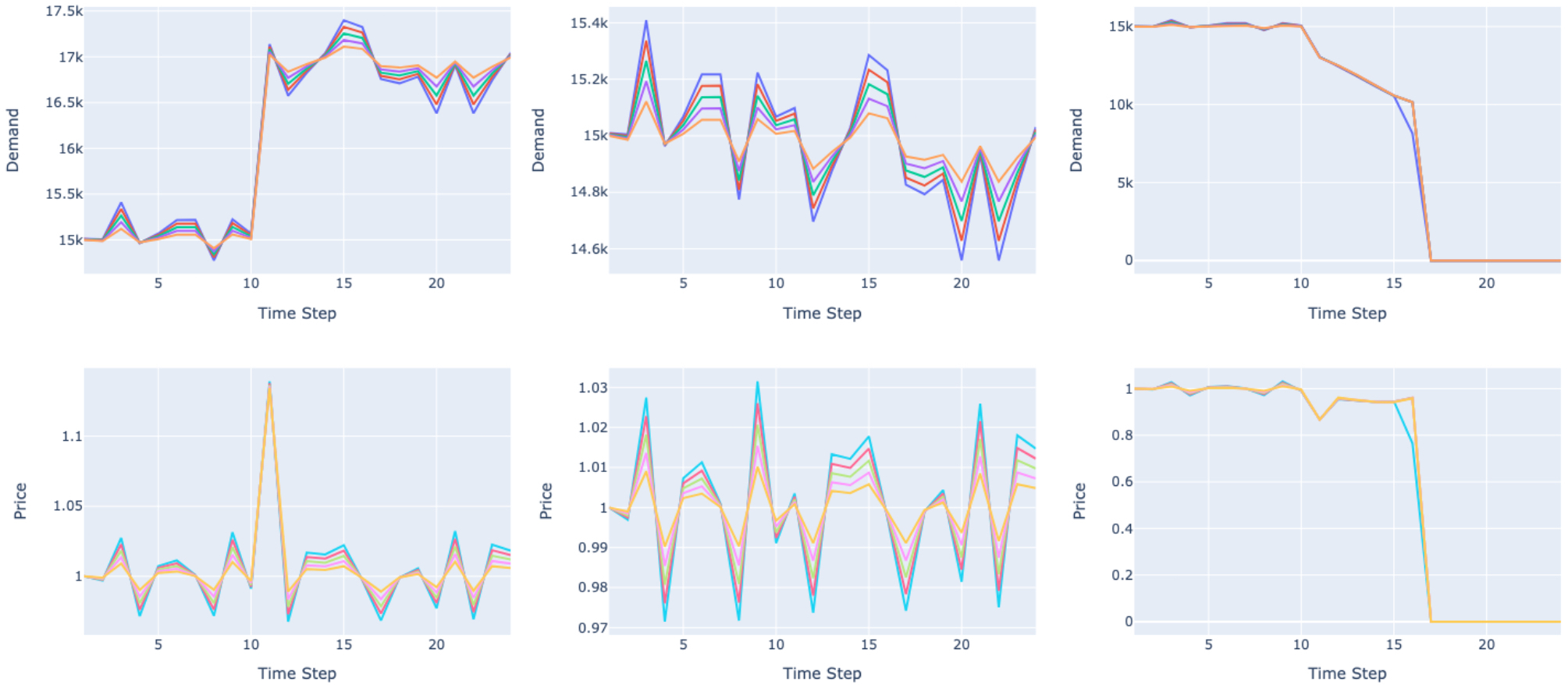

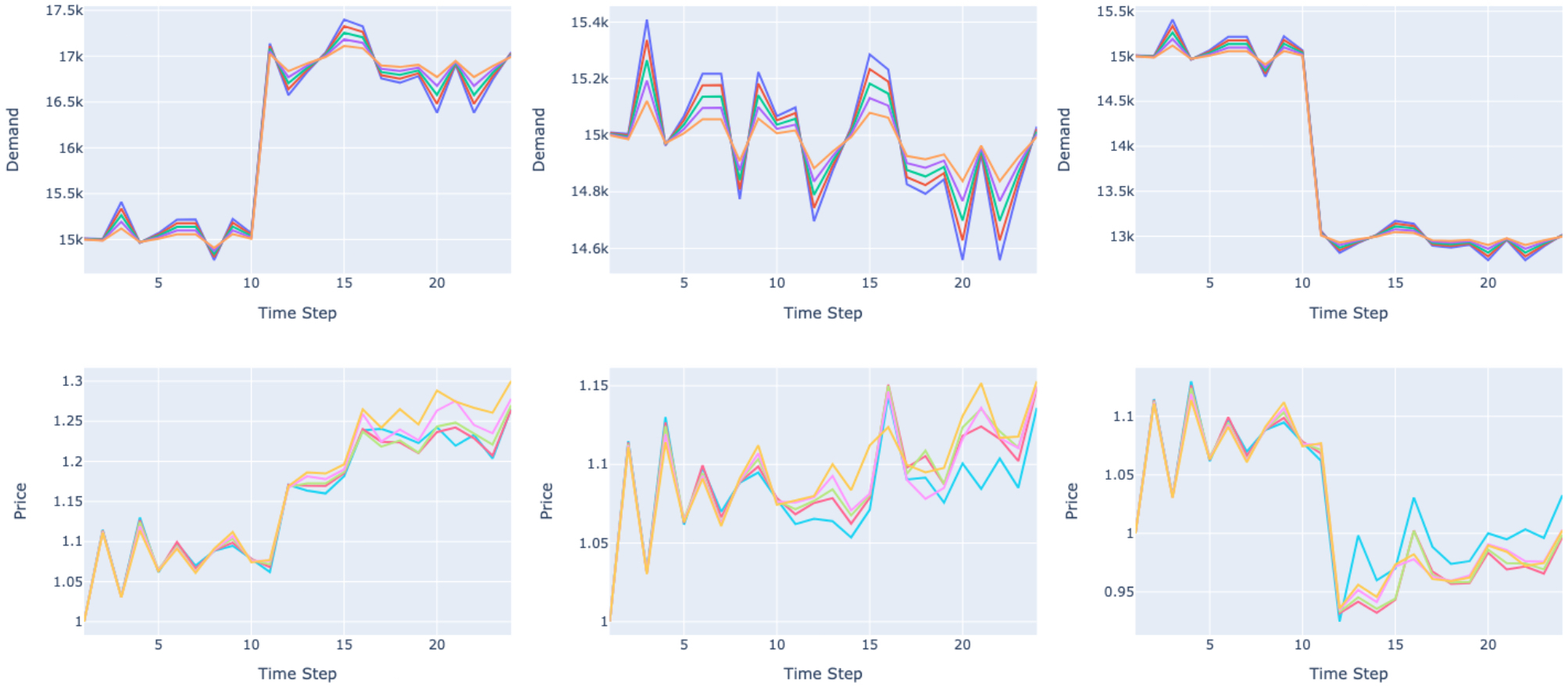

Demand Shock—Figures 1 and 2 present the results of the simulation for the following scenarios: baseline model without a shock (blue line), positive demand shock (green line), and negative demand shock (red line). Results are shown for each dimension of the matrix: stablecoins with (a) exogenous and centrally managed collateral such as USDT, (b) exogenous and decentrally managed collateral such as Dai, (c) endogenous and centrally managed collateral such as TerraUSD, and (d) endogenous and decentrally managed collateral such as sUSD. Figure 1 depicts the evolution of stablecoin demand following a demand shock,35 while Figure 2 depicts the evolution of stablecoin price.

Figures 1a and 1b show that stablecoins with exogenous collateral, regardless of how the collateral is managed (centrally or decentrally), stabilize at a new equilibrium level of demand after experiencing a demand shock. The increase and decrease in demand remain consistent for positive and negative shocks. Figure 1c and 1d illustrate the divergent responses of stablecoins

with endogenous collateral to negative demand shocks. Positive shocks elicit a similar effect for endogenous and exogenous collateral, but the reaction to negative demand shocks is markedly different. Stablecoins with endogenous and decentrally managed collateral cushion such shocks, while those with endogenous and centrally managed collateral are more vulnerable as demand fails to stabilize at a lower level and steadily decreases until it reaches zero.

The price evolution following a demand shock is shown in Figure 2.

Figure 2a shows that stablecoins with exogenous and centrally managed collateral typically experience an initial price increase in response to a positive demand shock and an initial price decrease following a negative shock. However, after a short time, the price recovers and eventually returns to (or close to) 1. This stablecoin type is resilient to demand shocks in the medium and long run. Figure 2b demonstrates that stablecoins with exogenous and decentrally managed collateral have a less accurate peg and thus do not always track perfectly the price of 1 USD as they experience significant price fluctuations. However, they do not fully crash to 0, indicating they maintain at least some stability.

Figure 2c shows a distinctive evolution for stablecoins with endogenous and centrally managed collateral. While the effect on price after a positive demand shock is initially similar to that of stablecoins with exogenous collateral, after a negative demand shock the price does not recover, and the stablecoin ultimately crashes. This crash is due to the “death spiral.”19,36 For this stablecoin type, a decrease in demand leads to a reduction in future profits with the native coin, reducing the demand and value of the native coin. In addition, because the native coin backs the stablecoin, the collateral value of the stablecoin is also reduced. Once the collateral value hits a critical level, the demand for the stablecoin further decreases, exacerbating the decline in its price. Prior to reaching this critical value, the stablecoin’s price does not immediately crash due to the presence of still-sufficient collateral backing. However, once the backing is no longer adequately high, the spiral becomes “deadly” for the stablecoin, and the stablecoin crashes.

Finally, Figure 2d reveals a critical insight: stablecoins with endogenous and decentrally managed collateral exhibit similar behavior to those with exogenous and decentrally managed collateral. This finding emphasizes the significance of maintaining a high over-collateralization and liquidation ratio to safeguard against demand shocks and the resulting insecurity that could potentially trigger a death spiral. The liquidation mechanism ensures that positions that fall below a certain collateralization ratio are liquidated promptly to prevent under-collateralized debt positions. By implementing such risk-management practices, stablecoin issuers can enhance the stability and resilience of their systems.

It is worth noting, however, that stablecoins with endogenous and decentrally managed collateral still experience significant price fluctuations that exceed those of stablecoins with exogenous and decentrally managed collateral. The more significant price fluctuations occur because the value of the collateral backing the stablecoin is directly tied to the value of the stablecoin itself, creating a feedback loop that can exacerbate price swings.

Case Analyses—This subsection presents real-world cases of stablecoins that empirically support the findings of our agent-based simulation.

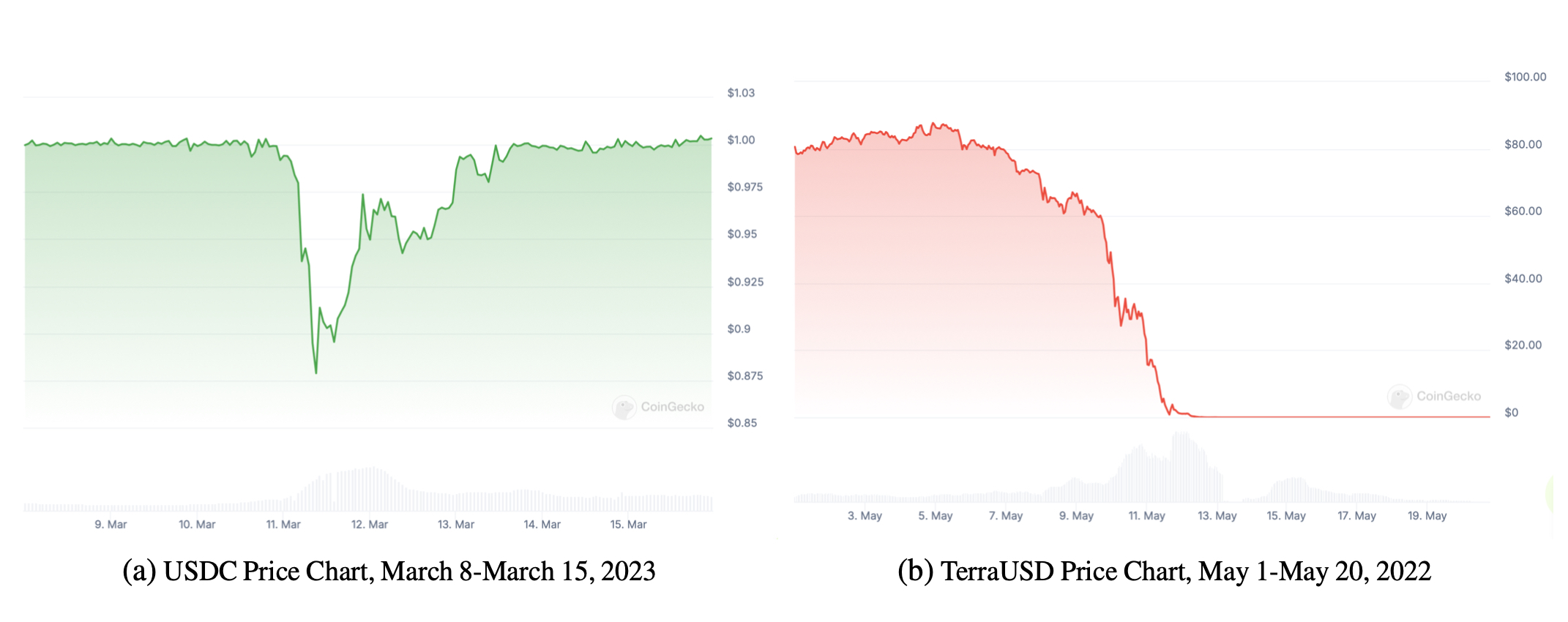

To begin, an examination of the recent incident involving USDC, a stablecoin with exogenous and centrally-managed collateral, which experienced a demand shock in March 2023, illustrates in Figure 3a that this type of stablecoin demonstrated a behavior consistent with our simulation model (compare Figure 2a): Following the demand shock, the price initially declined but ultimately recovered.

Moreover, the TerraUSD crash in May 2022 provides empirical evidence for a death spiral involving a stablecoin with endogenous and centrally managed collateral.38 Figure 3b illustrates that following the demand shock, the price fell below one USD, briefly remaining below one and above zero before ultimately spiraling to zero as in our simulation (see Figure 2c).

Finally, the behaviors predicted by our simulation that are illustrated in Figures 2b and 2d can be empirically validated by comparing historical price data of these types of stablecoins. A comparison of the price volatility of Dai and sUSD reveals that the price volatility of sUSD has been significantly higher than that of Dai, while the price volatility of Dai has been significantly higher than that of USDT or USDC (compare Table 2). This is again consistent with our simulation results. It is evident that TerraUSD exhibits the highest price volatility.

Table 2. Comparison of historical price volatility.39

Price | Volatility | Market Cap | Circulating Supply | |

sUSD | $ 0.997 | 0.19% | $ 61.32M | sUSD 61.47M |

DAI | $ 1.00 | 0.06% | $ 5.25B | DAI 5.25B |

USDT | $ 1.00 | 0.03% | $ 109.89B | USDT 109.84B |

USDC | $ 1.00 | 0.01% | $ 33.01B | USDC 33.00B |

TerraUSD | $ 0.000 | 6.49% | $ 647.49M | TerraUSD 5.82T |

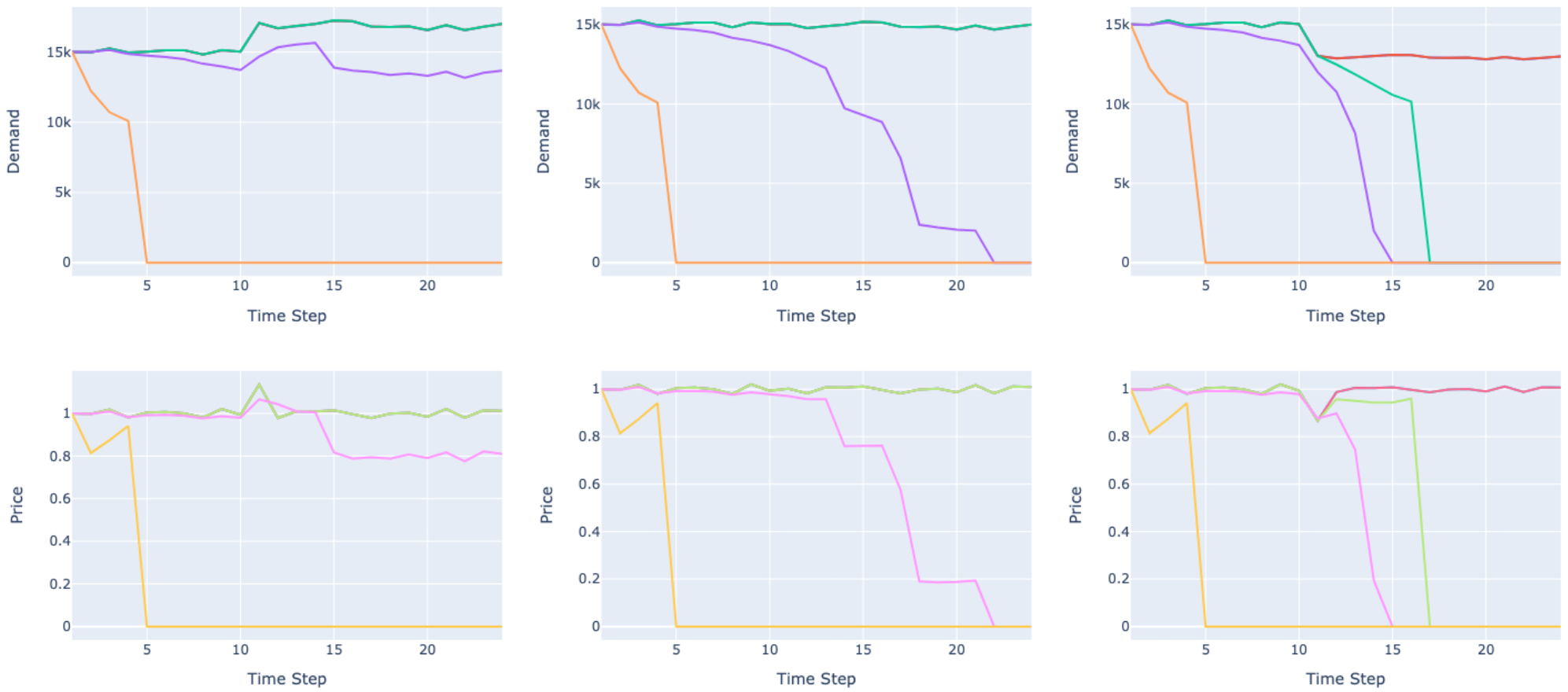

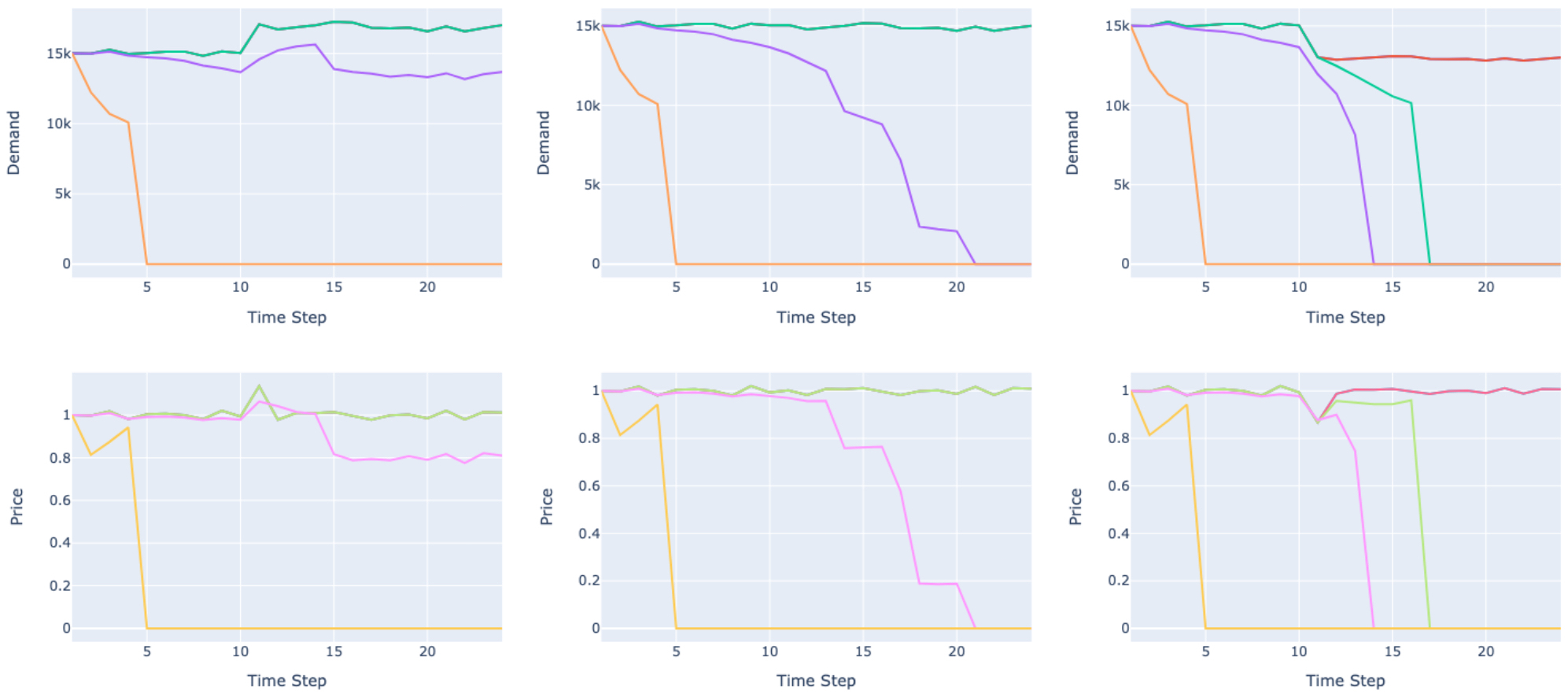

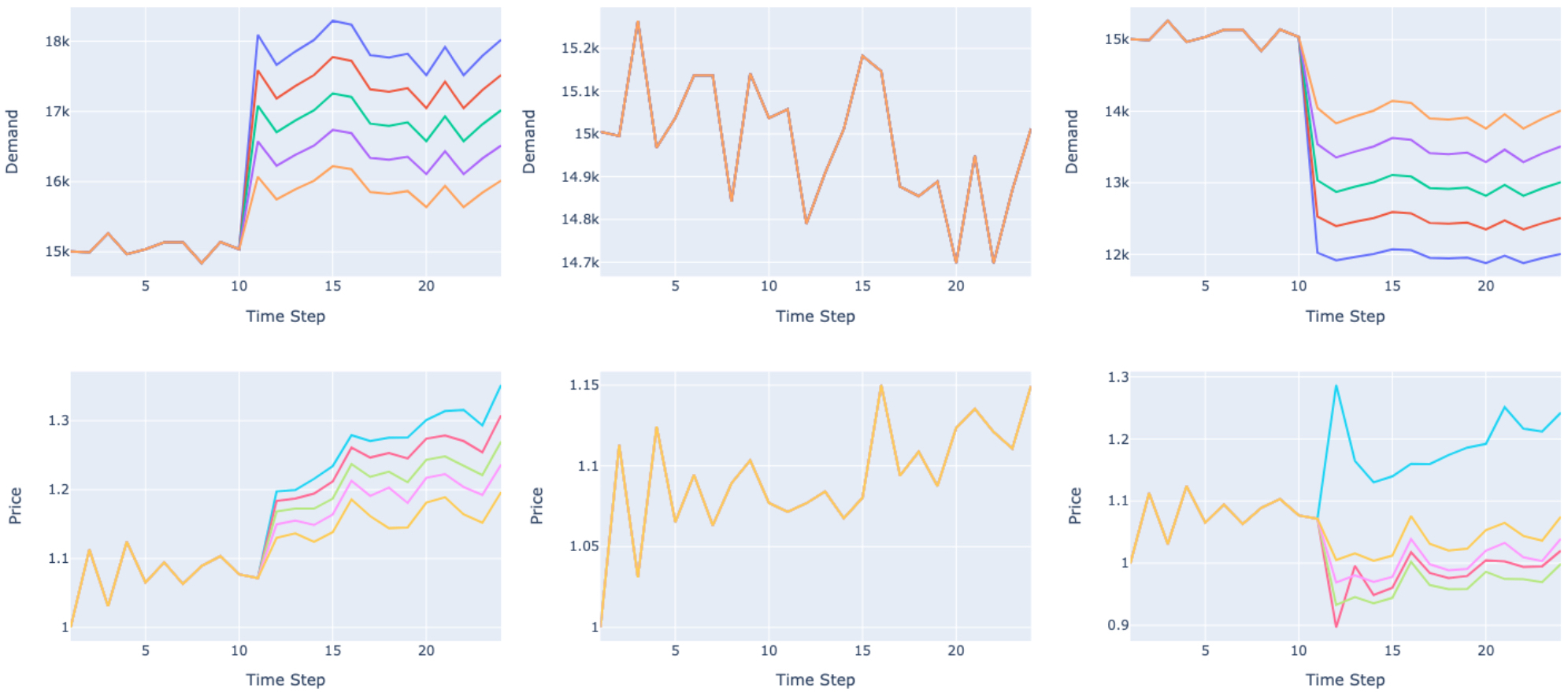

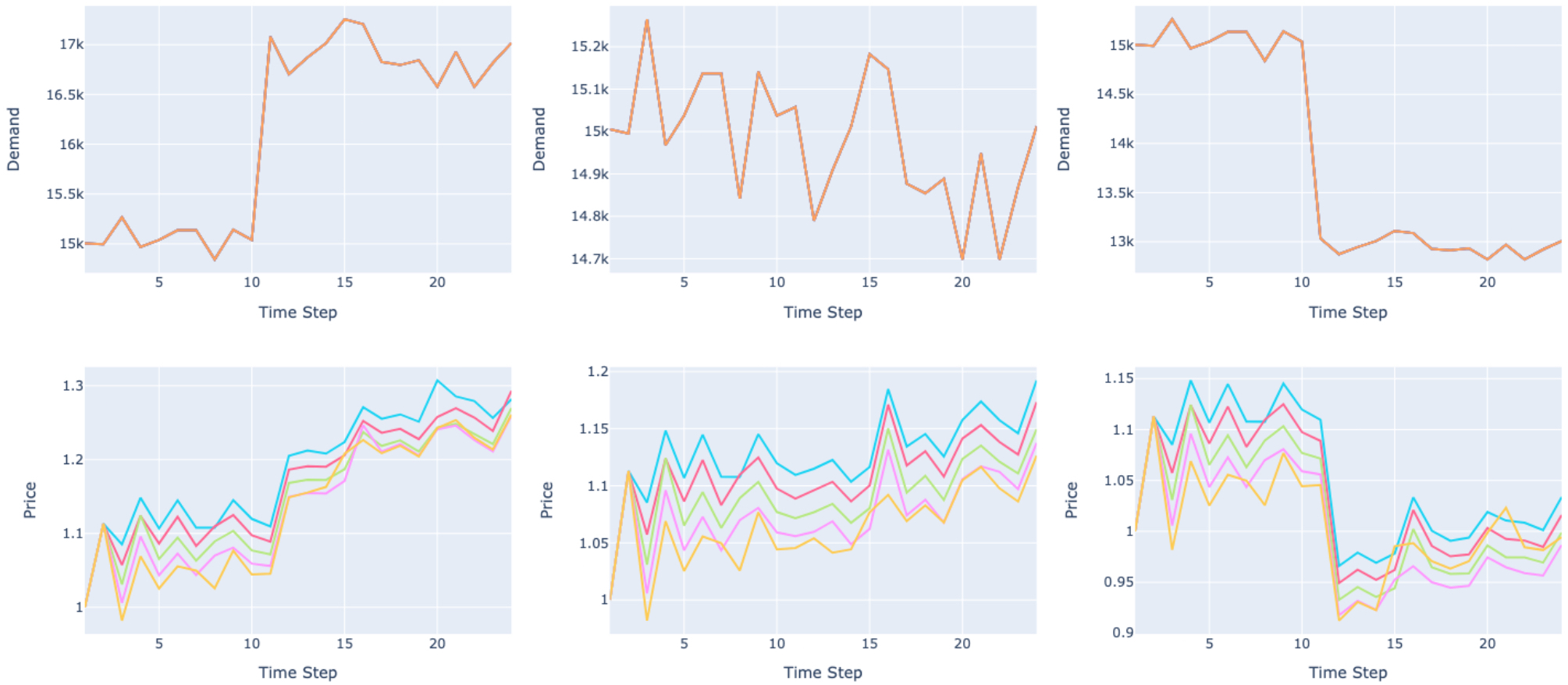

Sensitivity Analyses—To assess the robustness of our findings, we conduct sensitivity analyses on key factors including the magnitude of the demand shock, the volatility in demand, the fees, and the price of the (exogenous or the endogenous) collateral. These analyses allow us to explore the effects of deviations from our initial values in our model (Appendix D). The discussion of the results of sensitivity analyses and the corresponding figures for each stablecoin type can be found in the Appendices E, F, G, and H.

The sensitivity analyses confirm the robustness of our results, emphasizing the instability of endogenous/centrally managed stablecoins and the significance of collateral and fees in stablecoin dynamics.

Trilemma—As the choice of stablecoin heavily depends on individual use cases and preferences, no single type of stablecoin can be considered the “best.” Instead, there are trade-offs between (i) stability, (ii) independence, and (iii) costs. Stability refers to the ability of a system or currency to maintain a consistent value and avoid excessive fluctuations or crashing. Independence refers to the absence of a single issuer that centrally manages the collateral. This independence ensures that each individual stablecoin is always backed by collateral, thereby mitigating the risk of bank runs (see also discussion on bank runs in Appendix I). Relevant costs are the sum of fees and opportunity costs due to over-collateralization.

The trilemma manifests itself in each of the four categories of stablecoins. These categories represent different approaches to achieving stability, independence, and costs.

[1] Exogenous/centrally managed collateral (e.g., USDT): Stablecoins in this category do not require significant over-collateralization, making them cost-effective. However, their drawback is lack of independence. With centralized collateral management, investors face the risk of not being able to redeem the stablecoin for the collateral, resulting in bank-runs. In contrast, with decentralized collateral, users can always redeem the stablecoin by design (as long as their positions are not liquidated).

[2] Exogenous/decentrally managed collateral (e.g., Dai): Stablecoins in this category demonstrate stability in our simulation. However, they fluctuate more due to liquidations and higher required over-collateralization.

[3] Endogenous/centrally managed collateral (e.g., TerraUSD): Stablecoins in this category fail to prevent price crashes under many circumstances as seen in the sensitivity analysis, rendering them unreliable options. Their relative costs gains become inconsequential in light of this issue. Additionally, the independence concern raised for Tether-like stablecoins applies here, as this category relies on centralized collateral management.

[4] Endogenous/decentrally managed collateral (e.g., sUSD): Stablecoins in this category demonstrate stability in our simulation despite their endogenous backing, such as sUSD backed by the blockchain’s native token, SNX. However, achieving this stability comes at a higher cost, as these stablecoins need to be significantly over-collateralized. Like Dai-like stablecoins, they offer more independence but may also experience price fluctuations.

Overall, stablecoins with exogenous collateral like Dai or USDT are expected to perform well in terms of stability. However, they remain dependent on their collateral assets and lack the ability to react or counteract if the external collateral fails. On the other hand, sUSD-like stablecoins provide stability and independence through decentralized management and liquidations. However, the trilemma still exists due to the concerns, discussed earlier, about endogenous collateral and the less efficient issuance of sUSD, which requires over-collateralization at a rate of 400%, compared to approximately 150% for Dai and 100% for Tether.

Based on their characteristics, we can draw some general conclusions about the stability of each stablecoin type.40 Dai offers high security against demand shocks and bank runs. However, without additional mechanisms, it is susceptible to significant price fluctuations, which may deter some users. USDT, although more stable, is more prone to bank runs due to centralized collateral management. While sUSD benefits from complete independence and decentralization, its endogenous collateral can lead to even larger price adjustments than Dai. These adjustments occur because the value of the collateral backing sUSD directly influences its value, creating a feedback loop that can amplify price swings. Despite this potential for increased volatility, sUSD’s decentralized and independent nature has made it popular among users valuing trustless and permissionless stablecoins.

Ultimately, the choice of stablecoin depends on individual preferences and priorities regarding stability, independence, and costs.

Policy Implications—This section discusses policy implications of our findings and includes a brief overview of international perspectives on stablecoin regulation.

The high volatility of the crypotmarket, the fear of unstable stablecoins, such as TerraUSD which had worldwide media attention, and of course the growing adoption of stablecoins in general have raised concerns about potential systemic risks, including bankruns, among financial regulators all over the world. To mitigate these risks, policymakers should implement regulations to ensure that such stablecoins maintain high levels of liquidity and sufficient collateral reserves. For stablecoins that utilize an endogenous source of collateral, more stringent requirements such as over-collateralization are necessary to ensure stability.

In the United States, discussions about stablecoin regulation are particularly active. The U.S. Treasury advocates for regulating stablecoin issuers as banks or similar financial institutions, aiming to maintain stablecoin value during financial stress. Legislative proposals, including the Stablecoin TRUST Act of 2022,41 propose a distinct federal framework for stablecoins, requiring them to be fully backed by highly liquid traditional assets and subject to regular audits. Our analysis shows that decentralized stablecoins that use liquid cryptocurrencies (e.g., DAI) can be less prone to failure than centrally managed stablecoins. We cannot, therefore, follow the recommendation by the TRUST Act, which would disallow DAI from using cryptocurrencies as collateral. Our analysis indicates that the type of collateral alone is not the relevant factor; the mechanism is more important. Regulators should thus focus more on the management of collateral and less on the type. Moreover, a draft for a stablecoin bill argues that stablecoins with endogenous collateral sources might not be suitable for use.6, 42 We suggest regulators should consider not only the collateral source but also collateral management, as stablecoins with endogenous and decentrally managed collateral have demonstrated their functionality thus far (e.g., sUSD).

The European Union has proactively addressed stablecoin regulation with its Markets in Crypto-Assets Regulation (MiCA),43 one of the first comprehensive legal frameworks for cryptoassets, including stablecoins. MiCA emphasizes transparency, requiring issuers to disclose their stabilization mechanisms and reserve management. MiCA also categorizes stablecoins based on their reference values—whether pegged to fiat currencies, commodities, or other assets—imposing specific operational requirements to mitigate risks like reserve runs. We suggest using our stablecoin categorization to better assess the strengths and weaknesses of specific stablecoins according to their type and not just based on their reference values.

In Asia, approaches vary: Japan has revised its Payment Services Act to recognize stablecoins as digital money, linking them to the YEN or another legal tender to ensure consumer protection.44 In contrast, China has banned all cryptocurrency transactions.

As stablecoin adoption increases worldwide, the response from international regulators has been diverse, reflecting different regional financial systems and risk tolerances. This variation highlights the significant influence of stablecoin regulation on global financial stability and innovation. To ensure the safe operation of stablecoins, policymakers must remain vigilant and proactive. Furthermore, as stablecoins continue to evolve, ongoing international dialogue and cooperation are crucial to align regulatory practices, manage risks, and balance innovations in financial technology with security and systemic stability.

This paper presented a new approach to categorizing stablecoins based on an economic perspective and analyzed their stability under different scenarios using agent-based simulation. We identified a trilemma of stability, independence, and costs. We observed that stablecoins with endogenous collateral are more prone to instability and that centralized collateral management increases the risk of a bank run. Stablecoins with decentralized collateral management can ensure the safety of a crash, but have higher price volatility than centralized stablecoins with an exogenous collateral source.

Given the nascent nature of this field, there are numerous avenues for future research. One fruitful approach would be to employ an empirical analysis of all available data on stablecoins to deepen insights into our four types of stablecoins and stablecoins in general. Comparative studies with other cryptocurrencies and traditional fiat currencies may uncover unique characteristics of stablecoins as a financial asset. Furthermore, an examination of stablecoins through the lens of competition economics could reveal potential winner-take-all dynamics and interactions with similar financial instruments, such as inflation-responsive “flatcoins.” Finally, an assessment of the influence of diverse regulatory environments on stablecoin operations could elucidate how policy shapes market behaviors and stability.

Based on our findings, we offer several actionable recommendations for practitioners and policymakers. Practitioners should gain a deep understanding of the mechanics and incentive schemes of each stablecoin under consideration and use our economic categorization as a preliminary guide to evaluate the strengths and weaknesses of different stablecoins, aiding in investment and transaction decisions. Given the pronounced instability of stablecoins with endogenous collateral, practitioners are advised to approach these currencies with caution. For policymakers, our findings underscore the importance of implementing stricter regulations for the unstable stablecoin type to mitigate systemic risks. At the same time, it may be advisable to adopt lighter regulatory frameworks for the more stable types, with the aim of encouraging innovation without compromising security. Summarizing, the solid foundation established by our findings equips researchers, practitioners, and policymakers with a robust framework to assess and address stablecoin stability in these contexts, facilitating informed decision-making in the ever-evolving landscape of digital currencies.

The authors thank the participants of the 1st Wolfram ChainScience Conference in Boston and the participants of the 5th Blockchain International Scientific Conference in Manchester for their valuable feedback.

All authors significantly contributed to the conceptualization and development of the ideas presented in this manuscript. MH and MHP developed the code to perform the simulation. MHP wrote the manuscript; MH, HD, and JB provided reviews and suggestions on all sections. All authors discussed the revision suggestions from the Wolfram ChainScience Conference committee and Ledger; MH and MHP updated the manuscript.

1 Bullmann, D., Klemm, J., Pinna, A. “In Search for Stability in Crypto-Assets: Are Stablecoins the Solution?” SSRN (accessed 25 July 2024) https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3444847.

2 Kołodziejczyk, H., Jarno, K. “Stablecoin–The Stable Cryptocurrency.” Studia BAS 64.3 155–170 (2020) https://doi.org/10.31268/StudiaBAS.2020.26.

3 Duan, K., Urquhart, A. “The Instability of Stablecoins.” Finance Research Letters 52 103573 (2023) https://doi.org/10.1016/j.frl.2022.103573.

4 Cho, J. “A Token Economics Explanation for the De-Pegging of the Algorithmic Stablecoin: Analysis of the Case of Terra.” Ledger 8 27–36 (2023) https://doi.org/10.5195/ledger.2023.283.

5 Chohan, U. W. “Are Stable Coins Stable?” SSRN (accessed 25 July 2024) http://dx.doi.org/10.2139/ssrn.3326823.

6 Kaloudis, G. “Draft U.S. Stablecoin Bill Shows Major Difference Between Stablecoins and CBDCs.” Coindesk (accessed 25 July 2024) https://www.coindesk.com/consensus-magazine/2023/04/17/us-stablecoin-bill-picks-winners-and-losers/.

7 Bank for International Settlements. “Investigating the Impact of Global Stablecoins.” G7 Working Groups on Stablecoins, CPMI Papers 187 (October 2009) https://www.bis.org/cpmi/publ/d187.htm.

8 Berentsen, A., Schär, F. “Stablecoins: The Quest for a Low-Volatility Cryptocurrency.” In A. Fatás (Ed.), The Cconomics of Fintech and Digital Currencies CEPR Press London 65–75 (2019) https://cepr.org/system/files/publication-files/60138-the_economics_of_fintech_and_digital_currencies.pdf#page=74.

9 No Author. “The State of Stablecoins.” Blockchain.com (accessed 25 July 2024) https://www.blockchain.com/en/static/pdf/StablecoinsReportFinal.pdf.

10 Clark, J., Demirag, D., Moosavi, S. “Demystifying Stablecoins: Cryptography Meets Monetary Policy.” Queue 18.1 39–60 (2020) https://doi.org/10.1145/3387945.3388781.

11 Grobys, K., Junttila, J., Kolari, J. W., Sapkota, N. “On the Stability of Stablecoins.” Journal of Empirical Finance 64 207–223 (2021) https://doi.org/10.1016/j.jempfin.2021.09.002.

12 Kahya, A., Krishnamachari, B., Yun, S. “Reducing the Volatility of Cryptocurrencies–A Survey of Stablecoins.” arXiv (accessed 25 July 2024) https://doi.org/10.48550/arXiv.2103.01340.

13 Zhang, A. R.,et al. “The Regulation Paradox of Initial Coin Offerings: A Case Study Approach.” Frontiers in Blockchain 2.2 (2019) https://doi.org/10.3389/fbloc.2019.00002.

14 Aloui, C., ben Hamida, H., Yarovaya, L. “Are Islamic Gold-Backed Cryptocurrencies Different?” Finance Research Letters 39 101615 (2021) https://doi.org/10.1016/j.frl.2020.101615.

15 Yadav, S., Sharma, D., Mahakur, M., Aggarwal, K., Rani, M. “Design Regulation and Ramification – Stability in Cryptocurrency, Investment in Cryptocurrency, Benefits, Risks, Tips of Investments in Cryptocurrency (Stable Coins).” International Research Journal of Modernization in Engineering Technology and Science 3.3 2310–2316 (2021) https://www.irjmets.com/uploadedfiles/paper/volume3/issue_3_march_2021/6919/1628083295.pdf.

16 Zhao, W., Li, H., Yuan, Y. “Understand Volatility of Algorithmic Stablecoin: Modeling, Verification and Empirical Analysis.” In Financial Cryptography and Data Security. FC 2021 International Workshops: CoDecFin, DeFi, VOTING, and WTSC, Virtual Event, March 5, 2021, Revised Selected Papers 25 Springer 97–108 (2021) https://arxiv.org/pdf/2101.08423.pdf.

17 Moin, A., Sekniqi, K., Sirer, E. G. “SoK: A Classification Framework for Stablecoin Designs.” In Financial Cryptography and Data Security: 24th International Conference, FC 2020, Kota Kinabalu, Malaysia, February 10–14, 2020 Revised Selected Papers 24 Springer 174–197 (2020) https://doi.org/10.48550/arXiv.1910.10098.

18 Klages-Mundt, A., Harz, D., Gudgeon, L., Liu, J.-Y., Minca, A. “Stablecoins 2.0: Economic Foundations and Risk-Based Models.” In Proceedings of the 2nd ACM Conference on Advances in Financial Technologies 59–79 (2020) https://doi.org/10.1145/3419614.3423261.

19 Klages-Mundt, A., Minca, A. “While Stability Lasts: A Stochastic Model of Noncustodial Stablecoins.” Mathematical Finance 32.4 943–981 (2022) https://doi.org/10.1111/mafi.12357.

20 No Author. “Tether: Fiat Currencies on the Bitcoin Blockchain.” Tether Foundation (accessed 25 July 2024) https://tether.to/en/whitepaper.

21 No author. “Introducing USD Coin.” Circle (accessed 24 July 2024) https://www.circle.com/blog/introducing-usd-coin.

22 The Maker Team. “The Dai Stablecoin System.” Maker DAO (accessed 25 July 2024) https://makerdao.com/whitepaper/DaiDec17WP.pdf.

23 Kereiakes, E., Do Kwon, M. D. M., Platias, N. “Terra Money: Stability and Adoption.” (accessed 25 July 2024) https://assets.website-files.com/611153e7af981472d8da199c/618b02d13e938ae1f8ad1e45_Terra_White_paper.pdf.

24 No Author. “Synthetix Litepaper.” Synthetix (2023) Version 1.6 (accessed 25 July 2024) https://docs.synthetix.io/synthetix-protocol/the-synthetix-protocol/synthetix-litepaper.

25 This dimension has been proposed in previous research.18, 19 We call the dimension collateral source for consistency reasons.

26 Please refer to the whitepapers from Terra and sUSD for additional context on the mechanisms of endogenous stability.23, 24

27 This dimension has been discussed by, e.g., Berentsen and Schär (2019) but not brought into a 2 × 2 matrix or 3 × 3 cube.8

28 No Author. “USDD: Over-Collateralized Decentralized Stablecoin Protocol.” TRON DAO V2.3 (December 2022) https://usdd.io/USDD-en.pdf.

29 No Author. “About the Ampleforth Protocol.” Ampleforth (accessed 25 July 2024) https://docs.ampleforth.org/learn/about-the-ampleforth-protocol.

30 Agent-based simulations have been used in simulating currencies and can be adapted to simulate stablecoins.45

31 Investors purchase stablecoins directly from issuers, whereas users buy stablecoins from investors in the market.

32 In our initial model, we incorporate a shock of 40% at time step 10 of 24. However, in our sensitivity analysis (subsection 4.3), we explore the results with both larger and smaller shocks to provide a comprehensive examination.

33 Staking in the context of cryptocurrencies refers to the act of holding and voluntarily locking up specific digital assets within a blockchain network for the purpose of supporting its operations and earning rewards (https://www.coinbase.com/learn/crypto-basics/what-is-staking.

34 “g” can be a positive (e.g., sUSD) or negative (e.g., Dai) number.

35 As shown in Equation 1, each type has the same demand function. The critical values are \(o_t\) and \(o_{crit}\), which can be different for each stablecoin and therefore influence demand differently. Only in Figure 1c is the critical value reached and thus the demand behaves differently from the others. So the demand is independent of the stablecoin type, unlike the price and staking functions, which depend on the specific stablecoin type.

36 Lyons, R. K., Viswanath-Natraj, G. “What Keeps Stablecoins Stable?” Journal of International Money and Finance 131 102777 (2023) https://doi.org/10.1016/j.jimonfin.2022.102777.

37 Data from coingecko.com.

38 Lee, S., Lee, J., Lee, Y. “Dissecting the Terra-LUNA Crash: Evidence from the Spillover Effect and Information Flow.” Finance Research Letters 53 103590 (2023) https://doi.org/10.1016/j.frl.2022.103590.

39 Data from cryptorank.io.

40 The exception is TerraUSD. Due to its centrally managed and endogenous collateral, this type may not offer significant advantages over the other types of stablecoins.

41 U.S. Congress. Senate. “Stablecoin TRUST Act of 2022.” S.5340, 117th Congress, 2nd Session, Introduced 22 December 2022 https://www.congress.gov/117/bills/s5340/BILLS-117s5340is.pdf

42 U.S. Congress. House Financial Services Committee. Subcommittee on Digital Assets, Financial Technology and Inclusion. “Discussion Draft of H.R. , To Provide Requirements for Payment Stablecoin Issuers, Research on a Digital Dollar, and for Other Purposes.” H.R , 118th Congress, 1st Session, Hearing 19 April 2023. Hearing and draft text available at: https://financialservices.house.gov/calendar/eventsingle.aspx?EventID=408691.

43 No Author. “Markets in Crypto-Assets Regulation (MiCA).” European Securities and Markets Authority (accessed 25 July 2024) https://www.esma.europa.eu/esmas-activities/digital-finance-and-innovation/markets-crypto-assets-regulation-mica.

44 No Author. “Payment Services Act, Chapter III-2: Crypto-Assets.” Government of Japan. Amendment to Act No. 59 of 2009, Latest Version Act No. 50 of 2020 (accessed 25 July 2024) Translation into English via Japanese Law Translation available at: https://www.japaneselawtranslation.go.jp/en/laws/view/3965/en#je_ch4.

45 Mainelli, M. R., Leitch, M., Demetis, D. “Economic Simulation of Cryptocurrencies and Their Control Mechanisms.” Ledger 4 27–36 (2019) https://doi.org/10.5195/ledger.2023.283.

46 Through simulations with an increased number of time steps, we have verified that this type exhibits stability not only immediately following smaller magnitude shocks but also in the long run.

47 Diamond, D. W., Dybvig, P. H. “Bank Runs, Deposit Insurance, and Liquidity.” Journal of Political Economy 91.3 401–419 (1983) https://doi.org/10.1086/261155.

Table 3. Mechanisms of each stablecoin type of new 2 × 2 matrix.

| Dimension | Mechanism |

| Centralized Collateral Management | Collateral is pooled together and the issuer functions as a central entity or is a smart contract responsible for managing the collateral. |

| Decentralized Collateral Management | "Everyone" has the ability to issue central-debt positions, which are subject to liquidation once a specific critical liquidation ratio is reached. |

| Exogenous Collateral Source | External to the blockchain system; the collateral has no interactions with the stablecoin other than backing the stablecoin. |

| Endogenous Collateral Source | Internal to the blockchain system; stablecoin value is derived from future trading fees or other financial remunerations. |

Fig. 4. Illustration of agent-based model algorithm.

We incorporate three control mechanisms in the model. The first ensures that the supply of every relevant asset, including stablecoins as well as endogenous and exogenous collateral, equals the sum of the specific asset amounts in agents’ wallets. This mechanism ensures that trades and other asset-producing or asset-destroying activities are accurately reflected in the supply of the asset and used to calculate the asset’s price.

The second control mechanism focuses on executing the model’s functions correctly. It includes verifying that prices remain non-negative and ensuring that demand remains within a reasonable range. For instance, the mechanism prevents negative prices from arising, which can occur in exceptional circumstances. Additionally, it establishes bounds on the range of demand to maintain the model’s realism and prevent unrealistic scenarios. If any essential value is unavailable or any irregularity is detected, the model generates an error message to alert the simulator that there might be an issue with the system’s functionality.

The third control mechanism involves a function that checks and verifies the issuance and resolution of each central-debt position at each time step. By incorporating these control mechanisms, the model safeguards accuracy, consistency, and realism while providing error notifications in case of any discrepancies or anomalies.

We employ a systematic approach by testing four different sensitivity factors. Each factor involved multiplies the specific variable by 0.5, 0.75, 1, 1.25, and 1.5. This methodology allows us to observe the outcomes when deviating from our initial values, exploring both lower and higher ranges of up to 50%. By employing this approach, we gain valuable insights into the impact of these deviations on our results, providing a comprehensive understanding of how variations in these factors influence stablecoin dynamics.

[1] Magnitude of demand shock: For stablecoin types with exogenous/centrally managed collateral, exogenous/decentrally managed collateral, and endogenous/decentrally managed collateral, we observe consistent results across the five sensitivity factors. The primary difference we observed was in the initial deviations of the price, which were smaller or larger depending on the sensitivity factor. However, crucially, the price and demand of these types were able to recover over time. For stablecoin types with endogenous/centrally managed collateral, we observe similar results for positive demand shocks. However, for negative demand shocks, we observed that this type only experiences a crash if the magnitude of the demand shock is sufficiently large; i.e., for sensitivity factors of 0.5 and 0.75, this type was able to recover without crashing.46 Conversely, for sensitivity factors of 1.25 and 1.5, we observed a crash, which intuitively occurred more rapidly with a higher magnitude of the demand shock.

[2] Volatility of demand: Across all stablecoin types, we consistently observe the same outcomes across the five sensitivity factors. While there is increased volatility in both demand and price, the overall findings and conclusions remain unchanged.

[3] Fees: For stablecoin types with exogenous/centrally managed collateral, variations in fees did not have a significant effect on either the demand or the price. However, for stablecoin types with exogenous/decentrally managed collateral or endogenous/decentrally managed collateral, adjusting the fees led to changes in both the demand and subsequent price. Additionally, for stablecoin types with endogenous/centrally managed collateral, changes in fees can even result in a crash, independent of any external shocks.

[4] Price of collateral: For stablecoin types with exogenous/decentrally managed collateral, endogenous/decentrally managed collateral, and endogenous/centrally managed collateral, we observe a strong dependence of the stablecoin price on the price of the collateral. In our simulation, stablecoin types with exogenous/centrally managed collateral are directly backed by fiat money, which restricts our ability to analyze shocks in the collateral’s price. This limitation arises because fiat money serves as both the collateral and the reference currency in the model. However, if we were to adjust the model similarly to the other stablecoin types, we would expect to obtain comparable results.

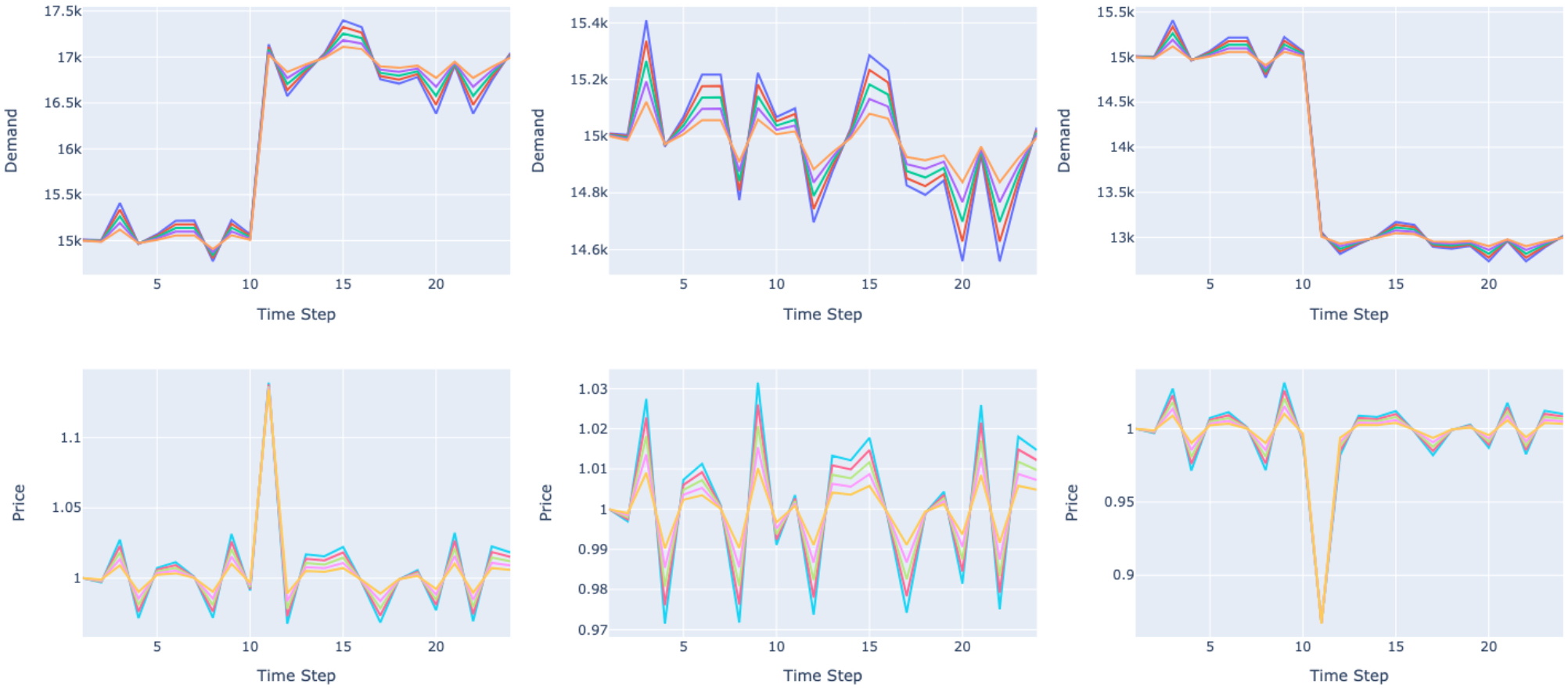

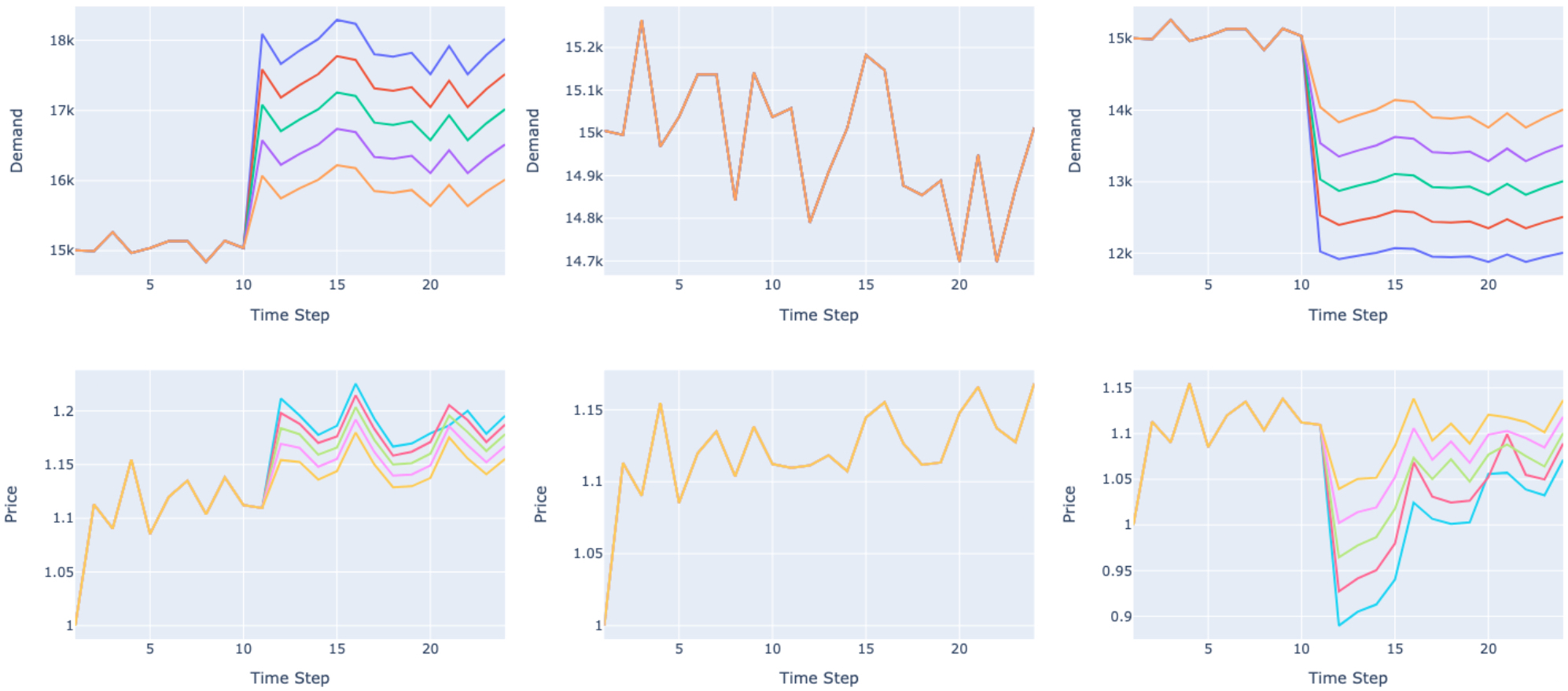

Fig. 5. Impact of different demand shocks on the demand and price of USDT.

Note. Demand is standardized and the price is in USD. The left column illustrates scenarios with positive demand shocks, the middle column with no demand shocks, and the right column with negative demand shocks.

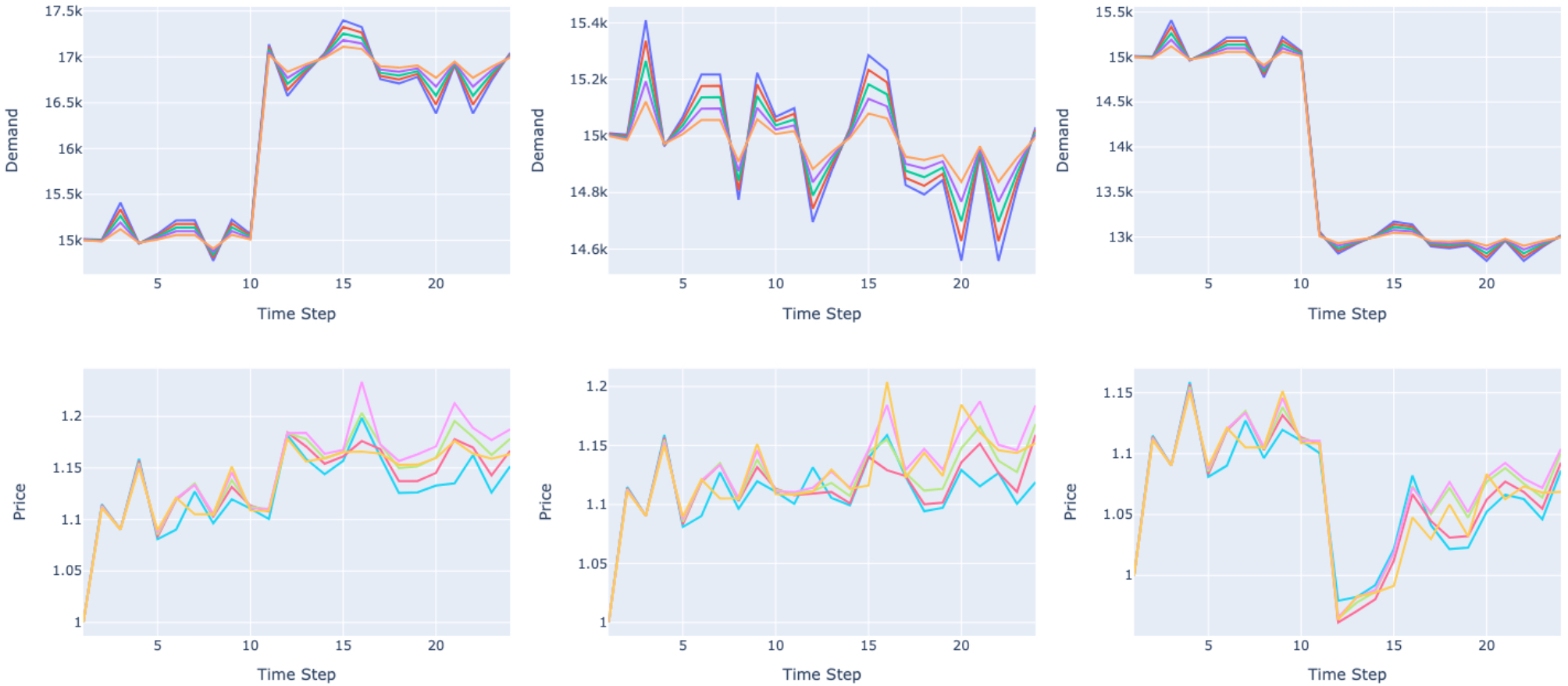

Fig. 6. Impact of different demand volatilities on the demand and price of USDT.

Note. Demand is standardized and the price is in USD. The left column illustrates scenarios with positive demand shocks, the middle column with no demand shocks, and the right column with negative demand shocks.

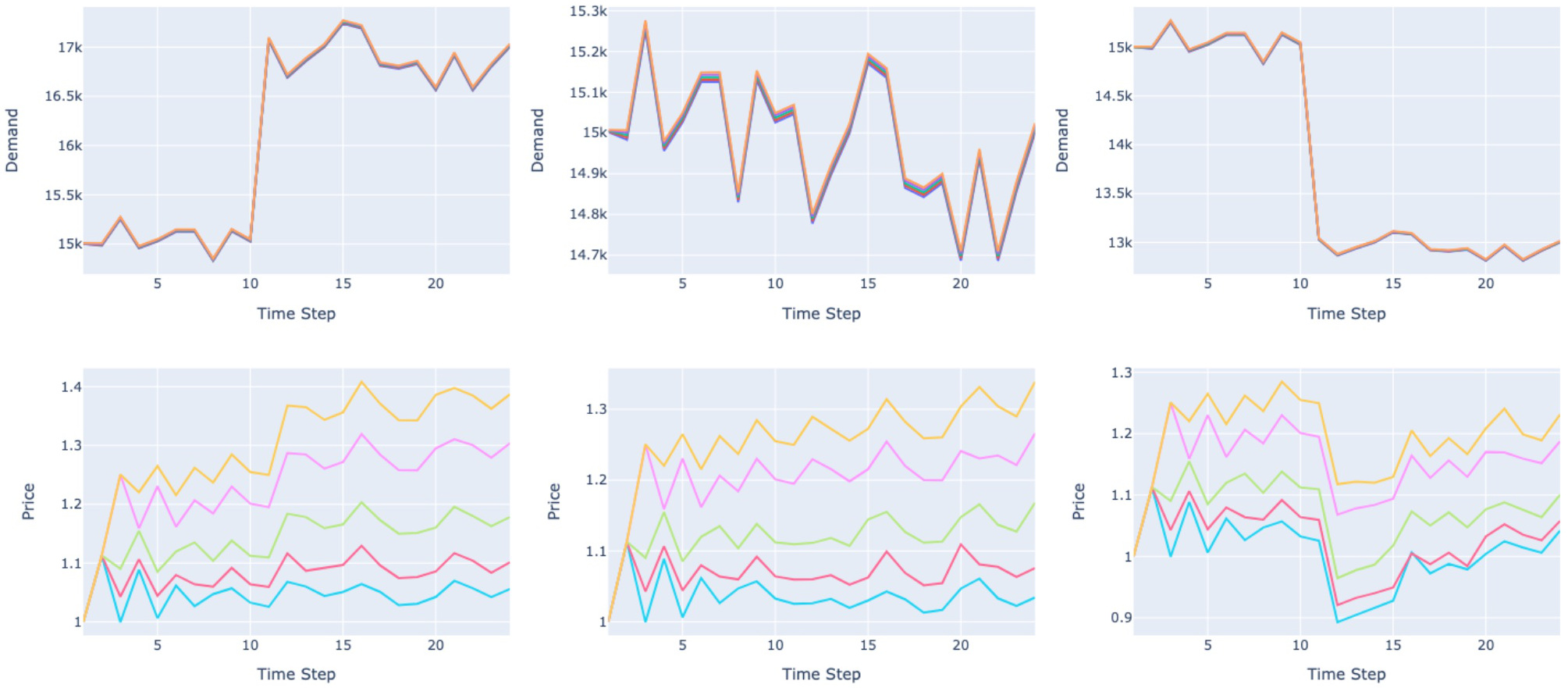

Fig. 7. Impact of different fee levels on the demand and price of USDT.

Note. Demand is standardized and the price is in USD. The left column illustrates scenarios with positive demand shocks, the middle column with no demand shocks, and the right column with negative demand shocks.

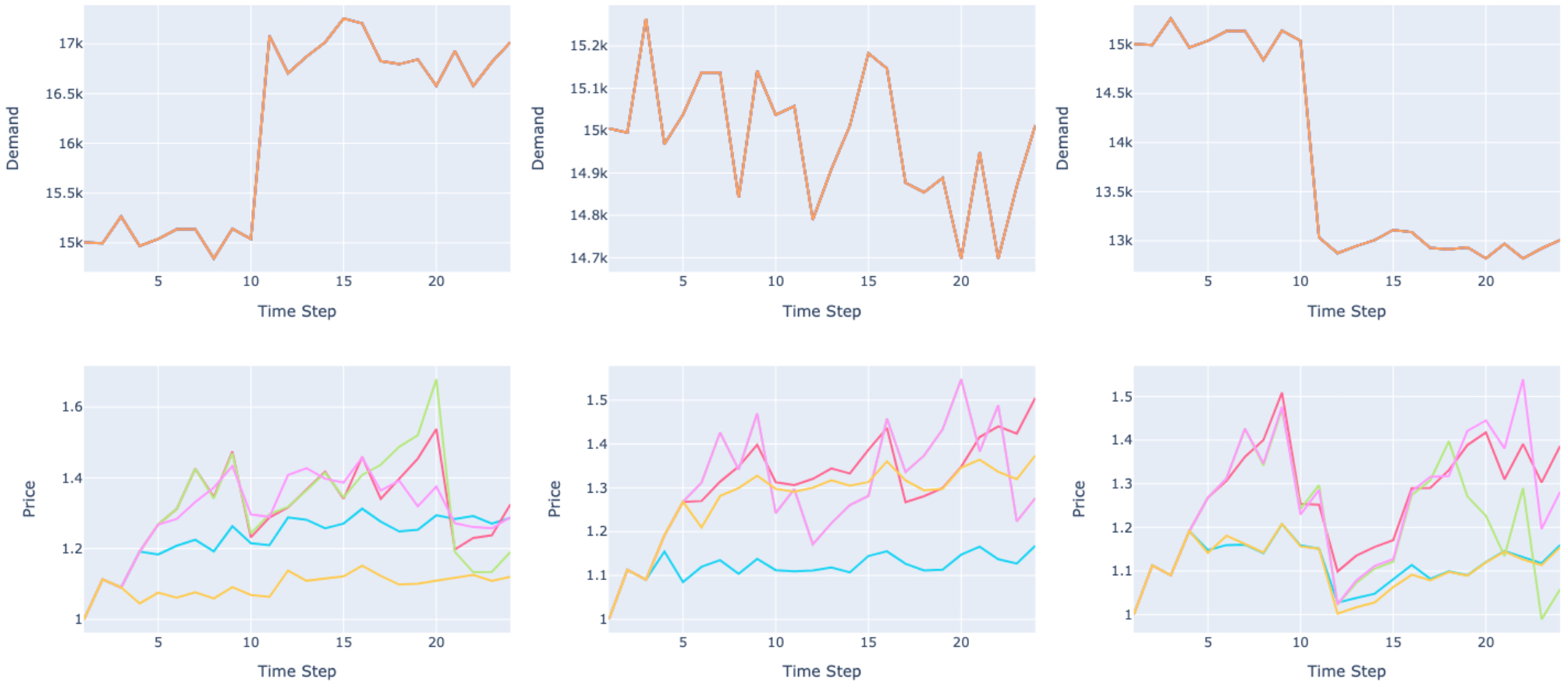

Fig. 8. Impact of different collateral price levels on the demand and price of USDT.

Note. Demand is standardized and the price is in USD. The left column illustrates scenarios with positive demand shocks, the middle column with no demand shocks, and the right column with negative demand shocks.

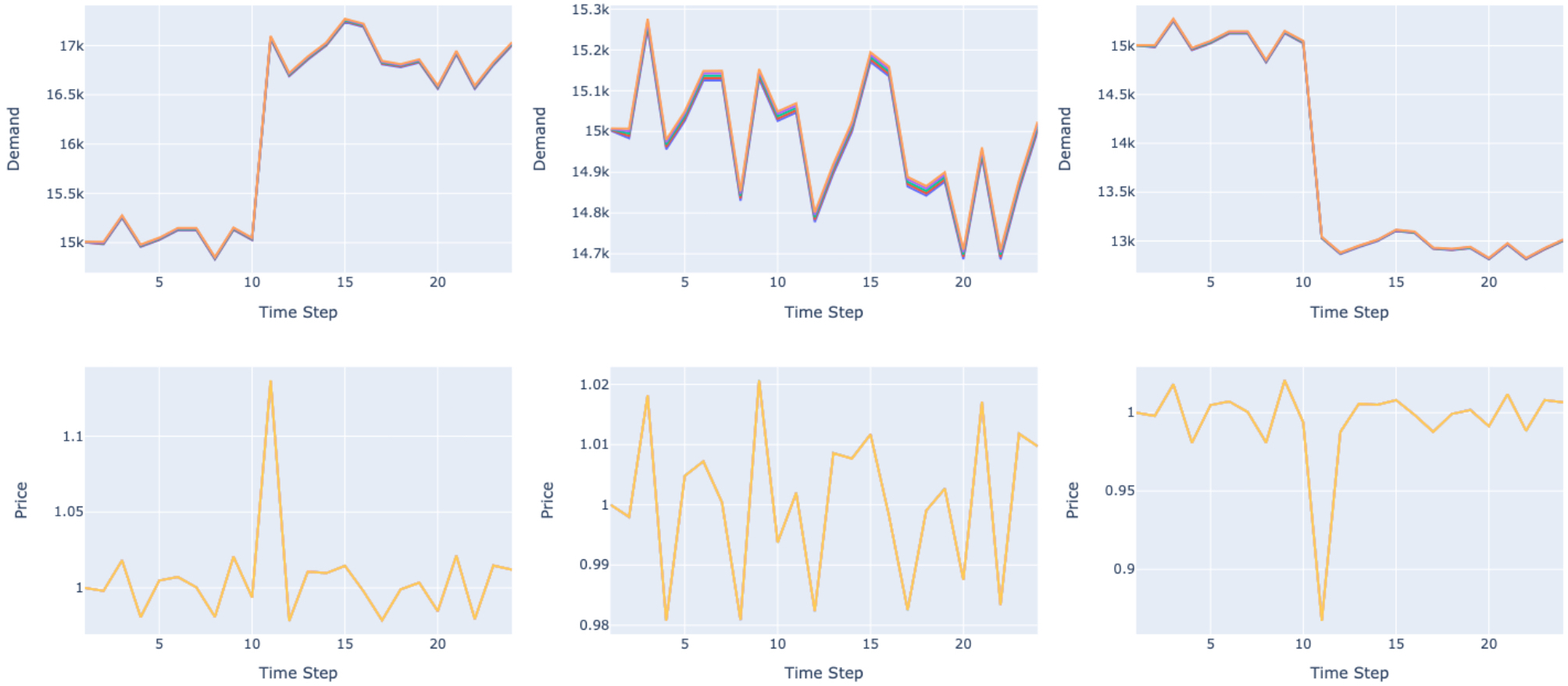

Fig. 9. Impact of different demand shocks on the demand and price of Dai.

Note. Demand is standardized and the price is in USD. The left column illustrates scenarios with positive demand shocks, the middle column with no demand shocks, and the right column with negative demand shocks.

Fig. 10. Impact of different demand volatilities on the demand and price of Dai.

Note. Demand is standardized and the price is in USD. The left column illustrates scenarios with positive demand shocks, the middle column with no demand shocks, and the right column with negative demand shocks.

Fig. 11. Impact of different fee levels on the demand and price of Dai.

Note. Demand is standardized and the price is in USD. The left column illustrates scenarios with positive demand shocks, the middle column with no demand shocks, and the right column with negative demand shocks.

Fig. 12. Impact of different collateral price levels on the demand and price of Dai.

Note. Demand is standardized and the price is in USD. The left column illustrates scenarios with positive demand shocks, the middle column with no demand shocks, and the right column with negative demand shocks.

Fig. 13. Impact of different demand shocks on the demand and price of TerraUSD.

Note. Demand is standardized and the price is in USD. The left column illustrates scenarios with positive demand shocks, the middle column with no demand shocks, and the right column with negative demand shocks.

Fig. 14. Impact of different demand volatilities on the demand and price of TerraUSD.

Note. Demand is standardized and the price is in USD. The left column illustrates scenarios with positive demand shocks, the middle column with no demand shocks, and the right column with negative demand shocks.

Fig. 15. Impact of different fee levels on the demand and price of TerraUSD.

Note. Demand is standardized and the price is in USD. The left column illustrates scenarios with positive demand shocks, the middle column with no demand shocks, and the right column with negative demand shocks.

Fig. 16. Impact of different collateral price levels on the demand and price of TerraUSD.

Note. Demand is standardized and the price is in USD. The left column illustrates scenarios with positive demand shocks, the middle column with no demand shocks, and the right column with negative demand shocks.

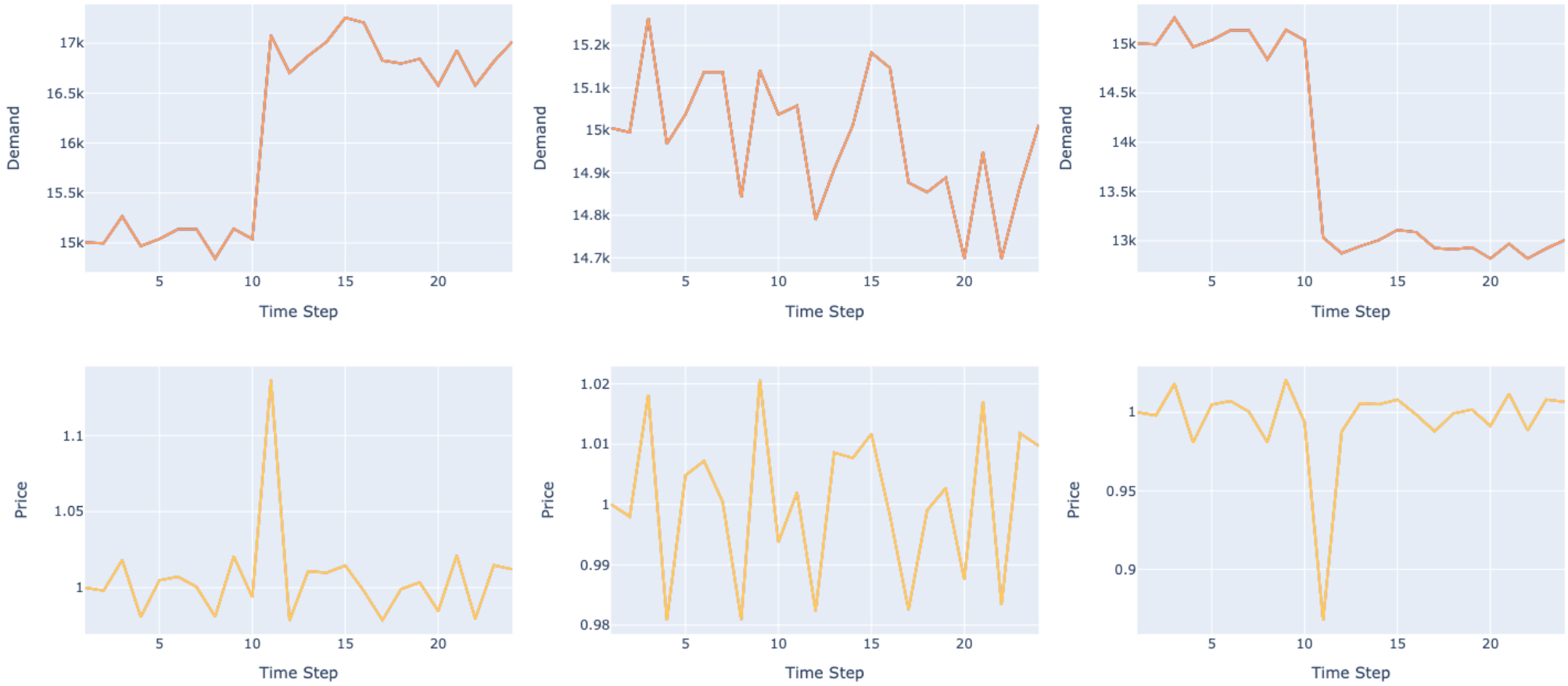

Fig. 17. Impact of different demand shocks on the demand and price of sUSD.

Note. Demand is standardized and the price is in USD. The left column illustrates scenarios with positive demand shocks, the middle column with no demand shocks, and the right column with negative demand shocks.

Fig. 18. Impact of different demand volatilities on the demand and price of sUSD.

Note. Demand is standardized and the price is in USD. The left column illustrates scenarios with positive demand shocks, the middle column with no demand shocks, and the right column with negative demand shocks.

Fig. 19. Impact of different fee levels on the demand and price of sUSD.

Note. Demand is standardized and the price is in USD. The left column illustrates scenarios with positive demand shocks, the middle column with no demand shocks, and the right column with negative demand shocks.

Fig. 20. Impact of different collateral price levels on the demand and price of sUSD.

Note. Demand is standardized and the price is in USD. The left column illustrates scenarios with positive demand shocks, the middle column with no demand shocks, and the right column with negative demand shocks.

A bank run is where a large number of depositors withdraw their deposits from a bank because they fear that the bank may not have enough money to meet their withdrawal requests. Bank runs are often triggered by rumors or fears of a bank’s insolvency or bankruptcy. As depositors withdraw their money, other depositors start to panic and also withdraw their funds, leading to a decline in the bank’s reserves. In extreme cases, bank runs can result in the bank being unable to meet its obligations. During a bank run, the bank may be forced to sell its assets at a loss, which can lead to a chain reaction of other banks being affected and a disruption of the monetary system, causing a reduction in production.47

In a centralized managed collateral system, a single entity—such as a central bank or a smart contract—controls the monetary system. As a result, depositors must rely on this entity’s ability to maintain the system’s stability and solvency. If the entity fails to do so, depositors may lose confidence in the system, triggering a bank run. In contrast, systems with decentrally managed collaterals, such as Dai or Synthetix, do not have a single entity that controls the monetary system. Users rely instead on a distributed network of investors that maintain the system’s collateral individually. This decentralized structure means no single entity can manipulate or control the system, significantly reducing the risk of bank runs.