![]()

ISSN 2379-5980 (online) DOI 10.5195/LEDGER.2023.278

RESEARCH ARTICLE

Economics of Open-Source Solar Photovoltaic Powered Cryptocurrency Mining

Matthew Tiger McDonald,* Koami Soulemane Hayibo,† Finn Hafting,‡ and Joshua M. Pearce §

![]()

* Matthew Tiger McDonald (mmcdo8@uwo.ca) is a Researcher in the Free Appropriate Sustainability Technology (FAST) Group in the Ivey Business School at Western University, London, Ontario, Canada.

†Koami Soulemane Hayibo (khayibo@uwo.ca) is Researcher in the FAST Group in the Department of Electrical and Computer

Engineering at Western University, London, Ontario, Canada.

‡ Finn Hafting (fhafting@uwo.ca) is Researcher in the FAST Group in the Department of Electrical and Computer Engineering at Western University, London, Ontario, Canada.

§ Joshua M. Pearce (joshua.pearce@uwo.ca) is the John M. Thompson Chair in Information Technology and Innovation and a Professor cross-appointed in the Ivey Business School and the Department of Electrical & Computer Engineering at Western University, London, Ontario, Canada (corresponding author).

![]()

In 2008, the Bitcoin (BTC) white paper was published and cryptocurrency has since gained popularity among both retail and commercial investors. 1–4 Bitcoin reached a market cap of $1.15 trillion in 2021 with approximately 83 million registered Bitcoin wallets on Blockchain.com and 89 million on Coinbase. 5–7 This activity has subsequently catalyzed the growth of Bitcoin miners. The purpose of Bitcoin is to provide a decentralized peer-to-peer electronic cash system leveraging blockchain technology.1 The Bitcoin Blockchain is a public ledger containing all the transactions on the Bitcoin network and bundling them into blocks that are the data structures that transactions are permanently recorded within and created every 10 minutes to regulate the creation of new Bitcoin. For this system to function, Bitcoin miners are tasked with confirming or denying these transactions through the processing of these blocks through a system called Proof of Work (PoW). PoW is achieved by solving mathematical algorithms unique to each block and broadcasting the results across the network to reach consensus. The transactions are chronologically added to the blockchain, and the miner who achieves this first is rewarded with Bitcoin from the network. The probability of a miner solving the mathematical algorithm is directly tied to computational power. The difficulty of the algorithm is adjusted in accordance with the number of miners on the network to ensure a block is mined every ten minutes. Thus, miners invest in powerful computing equipment for solving blocks to increase profitability.8 Individual miners seeking to establish consistency in block finding will choose to contribute hashing power to a community pool to receive a proportional reward from the community solved block for their contribution. 9, 10

Specialized mining equipment has evolved to maximize hashing power on mining computers and subsequently increased the electrical consumption requirements of each miner.11, 12 This has resulted in electricity costs becoming a fundamental expense, which thus dominates the financial feasibility of mining. As a result, miners continually search for the lowest electricity rates to maximize profitability. 13 Simultaneously, the ever-increasing electricity consumption of miners has become an environmental problem,14–16 because cryptocurrency mining today consumes electricity from non-renewable energy sources, such as fossil fuel combustion that emits pollutants. 17 – 19 Pollution from fossil-fuel generated electricity is destabilizing the global climate, causing severe impacts of climate change.20 This in turn creates threats to the food supply, with 1/3 of global food production being forced outside of a safe climate space,21 massive human health risks, increased mortality risks,22 and economic threats to the global economy.23 This environmental destruction has been a prevailing theme in the media regarding cryptocurrency, which has hindered its acceptance among the public, institutions, and green investors.24, 25 The rising electrical consumption of mining equipment to fuel the increase in hashing power of newly developed miners will continue to further damage the environment unless the cryptocurrency industry switches to renewable energy sources to facilitate sustainable operations. There is widespread agreement that energy sources must be capable of supplying sufficient electricity to miners at a lower cost than traditional sources to incentivize change without eroding the miner’s profitability. 26–33

To address the environmental and electrical issues of the Bitcoin mining process the utilization of solar photovoltaic (PV) generation, a sustainable and renewable energy resource,34 has the potential to be implemented at scale. This transition away from fossil fuels using PV not only provides a long list of environmental and health benefits,35 but also provides the lowest cost electricity to maximize profit margins. 36–38 Solar panels are modular and geographically flexible, 39–42 enabling miners to operate in various regions.31, 43–45

To analyze this promise, this study investigates the feasibility of using a PV system on an individual Antminer S17e miner,46 a DIY intermodal shipping container holding 50 Antminer S17e miners, and the MightyPOD commercial mining farm container from Bit-Ram capable of holding 408 Antminer S17e miners.47 A solar PV system is designed to power each of the three previous mining scenarios. In a controlled lab environment, a miner was monitored for electricity use. Simulations are provided with sensitivity ranges based on Bitcoin’s price, Bitcoin halving events, and miner hardware will be investigated for informed financial planning. In addition, sensitivity for geographic location and photovoltaic capital costs will be analyzed to generate a levelized cost of electricity compared to regional costs. The results will be discussed in the context of Bitcoin mining company, BitMG Inc., where the reduction in electricity cost through photovoltaics increases profitability. This study contributes to the body of knowledge in cryptocurrency mining by demonstrating the preservation of the environment through powering Bitcoin miners with a solar photovoltaic energy source while simultaneously maximizing profitability as an incentive. The feasibility of the study will adjust for sensitivity variables, and it will outline the explicit actions necessary to pursue the project in contrast to a general analysis. It will provide the basics of how to set up cryptocurrency miners at scale in addition to the design considerations for a solar photovoltaic energy system for mining.

Miner Set-up—To gather experimental values of a cryptocurrency mining rig’s functional specifications, an operational Antminer S17e miner manufactured by Bitmain was acquired from BitMG Inc. The factory specifications are shown in Table 1 where efficiency is measured in the number of joules (j) required to produce 1 billion hashes or 1 gigahash (Gh). The Antminer was brought into a ventilated indoor controlled lab environment and wired with two 1-meter-long power cables connected to two 240V electrical outlets. The miner was connected via ethernet directly to a Rogers Ignite Flex 5 XB6 internet modem to establish a reliable hardwired connection. 48 A laptop connected to the same network as the hardwired miner was used to log into the internet modem’s account by obtaining the IP address of the specific modem and pasting it into a browser. The connected device list was accessed to find the connected miner’s IP address which was pasted into a browser (e.g., the open-source FireFox) to access the miner’s dashboard.

In order to carry out hashing functionality, the miner would be connected to the mining pool Slushpool.49 The mining pool would deliver more consistent and reliable Bitcoin rewards as a proportion of its contributed hashing power to the mining pool.50 An account was created with Slushpool and the “add worker” tab was selected. The unique directory URL was copied to the clipboard and, after navigating back to the Antminer dashboard, was pasted into the pool URL section of the “miner configuration” tab. The miner was given 30 minutes to power on and connect with Slushpool to begin hashing. The overview tab on the Antminer dashboard was then consulted for any error messages impairing functionality. The Slushpool dashboard was consulted to verify that the miner was connected, and the hashing power was monitored to ensure the miner was operating at its approximate maximum hashing power of 64 TH/s. A 16- inch, 47 W, pedestal fan capable of 445 CFM was positioned near the heat exhaust to aid in expelling hot air away from the miner and ensure it was not recycled into the cool air intake of the miner causing it to power off. 51

Table 1. Miner Specification Comparison

![]()

| Miner | Cost (USD) | Hash rate (TH/s) | Power(W) | Dimensions (cm) | Weight (kg) | Efficiency (j/Gh) | Gross Bitcoin production | Profitability (USD/yr)a | Source |

|---|---|---|---|---|---|---|---|---|---|

| Antminer S9 & Power Supply | 806 | 13.5 | 1323 | 35 x 13.5 x 15.8 | 2.268 | 0.098 | 0.0207 | -$945 | Amazon52 |

| Antminer S17e | 1523 | 64 | 2880 | 33.8 x 17.5 x 30.4 | 10.5 | 0.045 | 0.0980 | -$930 | Bitmain46 |

| Antminer S19 XP | 11216 | 140 | 3010 | 40 x 19.5 x 29 | 14.4 | 0.022 | 0.2185 | $1402 | Bitmain53 |

![]()

a Calculated-on June 16th, 2022, with Bitcoin’s current price of $21,000 USD and electricity cost of $0.12 USD/kWh.

Diagnostic Measurements—In this experiment, an Antminer S17e miner was monitored for a 24-hour period. The experiment was repeated four times on four different Antminer S17e miners to ensure consistency in results. The hash rate was logged using Slushpool’s dashboard interface.

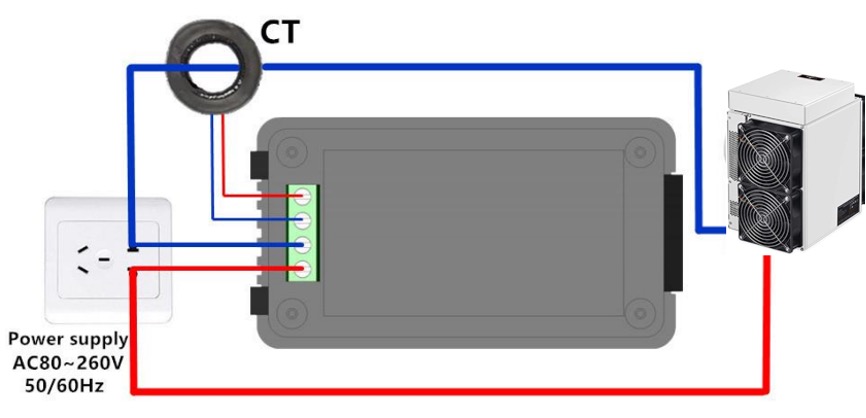

A PZEM-022 AC digital multi-function meter was integrated into one of the power cables of the miner to get precise electrical consumption measurements including voltage, current, power, energy, frequency, and power factor.54 The PZEM-022 has a measurement accuracy of 1.8VAC), as a 1.0 grade device, and the working voltage ranges from 80-260VAC, and is rated up to 100A at 22kW. The wiring schematic for the device is shown in Figure 1. The current probe (CT) is used to monitor the power consumption of the miner (load).

Figure 1. PZEM-022 AC Meter Wiring Diagram54

Cryptocurrency Miner Farm Container Designs

DIY Container—The capital costs for the DIY miner container farm are summarized in Table 2. All economic values are given in $USD in 2022.

Table 2. BitMG Inc. 2022 Capital Expenditure of Bitcoin Mining Farm

![]()

Component | Cost ($USD) | Quantity | Subtotal ($USD) | Source |

Antminer S17e | 1,523 | 50 | 76,150 | Bitmain46 |

Antminer Power Cables | 12 | 100 | 1,200 | Amazon55 |

Sea Container 2.4m x 6.1m | 3,018 | 1 | 3,018 | Northern Container56 |

Sea Container Delivery | 400 | 1 | 400 | Northern Container56 |

Transformer 225 kVA | 11,650 | 1 | 11,650 | Canada Transformers57 |

Electrical Engineer Service | 6,882 | 1 | 6,882 | BitMG Invoice58 |

Electrical Miscellaneous Parts58 | 4,893 | 1 | 4,892 | BitMG Invoice58 |

TECK #3/0/3C Cable 1 KV | 2,192 | 1 | 2,192 | BitMG Invoice58 |

Industrial Fan 61cm | 232 | 2 | 464 | Princess Auto59 |

Industrial Rack | 231 | 3 | 693 | Home Depot60 |

D-Link Ethernet Switch 24-port | 139 | 4 | 556 | Amazon61 |

3m Cat5e Ethernet Cable | 8 | 50 | 400 | Amazon62 |

Multi-function Ohm Reader | 755 | 1 | 755 | Intellimeter63 |

Industrial Duty Switch | 954 | 1 | 954 | Gescan64 |

3-Phase Main Breaker Load Center | 748 | 3 | 2,244 | Gescan65 |

Electrical Certification | 134 | 1 | 134 | BitMG Invoice58 |

Total | $112,584 |

Antminer S17e miners were purchased from Bitmain. The Sea Container was purchased to house the miners and was then engineered to separate the cool air intake and exhausted heat from the miners. This was achieved by stationing all miners on industrial racks in the same orientation of having the exhaust fans facing the wall of the container. The same wall was cut to reveal an opening for the heat to be exhausted away from the miners. A dividing separation wall that runs perpendicular to the side of the container was installed to prevent exhausted heat from flowing back to the cool air intake. An industrial fan stationed near the entrance of the container supported cool air intake toward the miners from the outdoor environment. A 225 kVA transformer provided the necessary electricity supply to the miners. Necessary electrical parts such as conduits and labor were billed accordingly. D-Link ethernet switchboards were installed inside the container and were wired directly to a nearby internet modem. Ethernet cables were purchased to hardwire each miner into these switchboards to connect to the network and begin hashing. The modified container was then approved and granted electrical certification to comply with safety regulations.

2.3.2. Commercial Mining Electrical Consumption and Requirements—To purchase a prefabricated commercial cryptocurrency mining container and begin mining, the online referral service Quotecolo was contacted via e-mail communication. 66 , 67 The commercial mining container provider Bit-Ram was referred and quoted for a 2.9m by 12.2m MightyPOD mining container with a 2.4m by 3.7m welded electrical room extension capable of supporting 408 Antminer S17e miners.47 The container has 240/415V AC 3-phase power with a calculated line current per phase pulled by the miners of 1632 A.66 The power load of the 408 Antminer S17e container set-up is calculated to be 1,275 kVA in which the transformer must be sized at 80% of the maximum consistent load, giving a minimum 1593 kVA rating on the transformer.66 The container is composed of 6 fully-balanced exhaust air system pods each holding 68 Antminer S17e miners with a quoted lead time of 8 weeks upon approval.66 The total cost of the container equipped with all necessary parts not including the miners or the transformer is $170,000 USD without shipping costs.66 The cost of the 408 Antminer S17e miners is $621,384 and the cost of four individual 0.5 MW transformers capable of a cumulative 2000 kVA which can support this operation is $36,000 USD as quoted by Quotecolo.66 Additional upgrades include warm air recirculation for $6,000, Exhaust silencers in lieu of weather hoods for $6,000, 24 SMART PDUs for $37,600, and 396 split power cords for $8,200.66 The cumulative initial investment cost for this commercial mining container is $827,384 with no upgrades and $885,184 with the additional upgrades.

Simulations.

Bitcoin Price—Bitcoin’s price valuation compared to USD is crucial in determining profitability for miners. The Bitcoin price must be high enough to cover the cost of electricity upon the sale and conversion of Bitcoin to USD for miners to profit. It should also be noted that miners may decide not to sell the Bitcoin they mine immediately due to speculation of future higher prices to cover electricity and investment costs more efficiently. Figure 2 demonstrated logarithmic regression growth curves to model Bitcoin’s price. Logarithmic Fibonacci levels are used in technical analysis for traders to predict price movements.68 The bottom regression line of the green-shaded region representing the calculated Fibonacci regression oversold range, denotes the 0% Fibonacci level. The mid regression line in the yellow-shaded region representing the calculated Fibonacci regression transition range, denotes the 50% Fibonacci level. The red-shaded region represents the calculated Fibonacci regression overbought range. The Bitcoin USD price of $35,731 and $80,480 at the 0% and 50% logarithmic regression Fibonacci levels, respectively, on 16 June 2022 along with the current price of $21,000 will be used for sensitivity calculations.

Antminer profitability calculators46 found that the Antminer S17e could mine on average 0.0980 Bitcoin per year with constant network difficulty.46 It should be noted that the network difficulty dictates how much the miner is able to mine per year. It is a dynamic number depending on other miners in the network and their hardware, which can reduce a given miner’s profitability. Here the annual average with a snapshot of the network difficulty number at this time was used. With electricity costs of $0.12/kWh equating to $2,988 and the low case of Bitcoin’s price at $21,000, miners would return -$930 profit if the Bitcoin were sold to cover costs immediately on a one-year time horizon. In the medium case of a $35,731 Bitcoin, miners would return $514 profit annually if the Bitcoin were sold to cover costs immediately with a 2.96-year payback period assuming a $1,523 initial investment (Table 1). In the high case of an $80,480 Bitcoin, miners would return $4,899 profit annually if the Bitcoin were sold to cover costs immediately with a 0.31-year payback period.

DIY container profitability with a conventional electricity source is calculated under the assumptions of a constant Bitcoin price of $35,731, production of 0.098 BTC per year per Antminer S17e, and $0.12/kWh electrical rate, the container will produce a gross 4.9 BTC per year with constant network difficulty. This would equate to $175,082 in revenue with an electrical cost of $149,400 and an annual net profit of $25,682.

Commercial MightyPOD container profitability with a conventional electricity source is calculated under similar assumptions. A constant Bitcoin price of $35,731 production of 0.098 BTC per year per Antminer S17e, and $0.12 kWh electrical rate, the container will produce a gross 39.984 BTC per year with constant network difficulty. This would equate to $1,428,668 in revenue with an electrical cost of $1,219,104 and an annual net profit of $209,564.

Figure 2. Bitcoin logarithmic price chart from the BITSTAMP exchange using the TradingView application on 30 May 2022. 69 Bitcoin price in $USD is on the y-axis and time is on the x-axis. Vertical green lines denote historic and future Bitcoin halving events. Regression curves are black and show both historic and future price predictions. Intermediate grey curves depict various Fibonacci retracement and extension levels. The shaded zones of red, yellow, and green represent price regions that are overbought, transitioning, and oversold respectively.

Solar PV System—To determine if the use of solar PV to provide cryptocurrency mining energy is profitable, three different solar PV systems are proposed for each type of mining operation, the single Antminer S17e, the proposed DIY mining container, and the commercial MightyPOD mining container. The System Advisor Model (SAM) software is selected to design the three PV systems. 70 SAM is preferred for PV systems design and simulation because it is open source, it is frequently updated, and its economic analysis tool accounts for the most recent values of equipment on the market.71, 72

The lifetime of the PV systems designed in this study is 25 years. For each system, the annual energy required by the miners is calculated by assuming the miners are operating 24/7 throughout the year. The annual energy consumed by the miners is then used to evaluate the solar PV power required to operate each system. The lifetime energy of the PV is calculated in SAM and the economic analysis tool of SAM provides the levelized cost of electricity (LCOE) of the selected PV system. The LCOE (USD/kWh) accounts for factors like the location of the miner, the type of PV system (residential or commercial), as well as the land acquisition cost if the system requires a large amount of space. The designed PV system is backed up by the electricity grid. The PV electricity is assumed net metered. The LCOE provided by SAM accounts only for the electricity produced by the PV system. Each PV system’s power is chosen to ensure the total energy production is as close as possible to the energy required by the corresponding mining system. It should be noted, however, that this formula is only accurate when the LCOE imported from the grid is equivalent to the LCOE exported to the grid (i.e. during net metering). The energy exported to the grid and the energy imported from the grid are not always an exact match, therefore the following equation is used to adjust the LCOE to account for the cost of energy difference during the exchange between the PV system and the grid throughout the lifetime of the system.

Six locations are selected for the study. Three of the selected locations, Toronto, Calgary, and Montreal, are in Canada, while the remaining three, Los Angeles, Boulder, and New York City, are in the United States. The existing solar energy incentives for each of the locations are considered in the LCOE calculation. For all locations in the U.S., a federal rebate of 26% is used.71 Among the locations in Canada, only Calgary in Alberta has a solar PV incentive. Therefore, incentive values for Calgary have been used, and no incentive was assumed for the other locations in Canada. For the simulation, a bifacial module with high efficiency is used.73 Also, each system is assumed to have an optimal tilt (tilt = latitude in SAM), and the default losses provided by SAM are used.

The detailed system design parameters are shown in Table 3 for Toronto. The cost of land is obtained from the Statistics Canada website for the Canadian cities and from the U.S. Department of Agriculture for the U.S. cities. 74, 75 The PV module used is the CSI Solar Co. Ltd. CS7N-670MB-AG and the module type is the monocrystalline silicon bifacial.73 These are identical for the three systems. The tilt angle used was determined by the relative latitude of the cities, with azimuth set at 180° for all three systems. The module cost is constant for the three systems at $0.41/Wdc with a 25-year lifespan.73 The soiling losses, DC power losses, AC power losses, and PV degradation rate are identical for the three systems at 5%, 3.5%, 1%, and 0.5% respectively.70 If costs are given in CAD, they are converted into USD using the rate of July 28, 2022 (1 CAD = 0.78 USD).

Table 3. System Design Parameters for the Case of Toronto if Land Cost is Considered

![]()

| Parameters | Antiminer S17e | DIY Mining Container | Comercial MightyPOD Container | Source |

|---|---|---|---|---|

| System Type | Residential | Commercial | Commercial | This Study |

| Number of Modules | 30 | 1500 | 11760 | |

| DC Power Rating | 20.1 kWdc | 1 MWdc | 7.9 MWdc | This Study |

| DC to AC Ratio | 1.01 | 1.10 | 0.85 | This Study |

| Inverter Cost (USD/Wdc) | 0.25 | 0.12 | 0.12 | NREL76 |

| Balance of System Cost (USD/Wdc) | 0.31 | 0.24 | 0.24 | NREL76 |

| Installation Labor Cost (USD/Wdc) | 0.19 | 0.15 | 0.15 | NREL76 |

| Installer Margin and Overhead (USD/Wdc) | 0.27 | 0.16 | 0.16 | NREL76 |

| Permitting and Environmental Studies (USD/Wdc) | 0.24 | 0.11 | 0.11 | NREL76 |

| Engineering Overhead Cost (USD/Wdc) | 0.98 | 0.44 | 0.44 | NREL76 |

| Required Land Area (m2) | 190.2 | 9,838 | 77,133 | This Study |

| Cost of Land in Ontario (USD/m2) | Not Used | 2.66 | 2.66 | Statistics Canada 74 |

| Total System Cost (USD) | 54,725 | 1,754,798 | 13,757,614 | This Study |

| Lifetime Energy of the PV (MWh) | 711 | 35,220 | 279,552 | This Study |

| Energy Required by the System (MWh) | 714 | 35,653 | 279,225 | This Study |

| Energy from the Grid (MWh) | 446 | 22,284 | 174,450 | This Study |

| Energy to the Grid (MWh) | 443 | 21,852 | 174,780 | This Study |

| Grid LCOE in Ontario (USD/kWh) | 0.01 | 0.01 | 0.01 | This Study |

| LCOE of the PV System (USD/kWh) | 0.133 | 0.052 | 0.052 | This Study |

| Adjusted LCOE (USD/kWh) | 0.133 | 0.053 | 0.051 | This Study |

![]()

Conventional Electricity Rates—Electricity cost is a fundamental expense to Bitcoin mining and variation of electrical rates must be accounted for according to different geographic regions. Electrical rates can also vary according to the time of day, representing on-peak and off-peak rates in some regions. Sensitivity analysis will use the electrical rates of the six locations (Toronto, Calgary, Montreal, Los Angeles, Boulder, and New York) to calculate electrical expense and profitability. Under the assumption that mining with one Antminer S17e will operate for 24 hours a day, the 2021 average residential electrical rate for one day in each city will be used with an assumed constant $35,731 USD Bitcoin valuation.

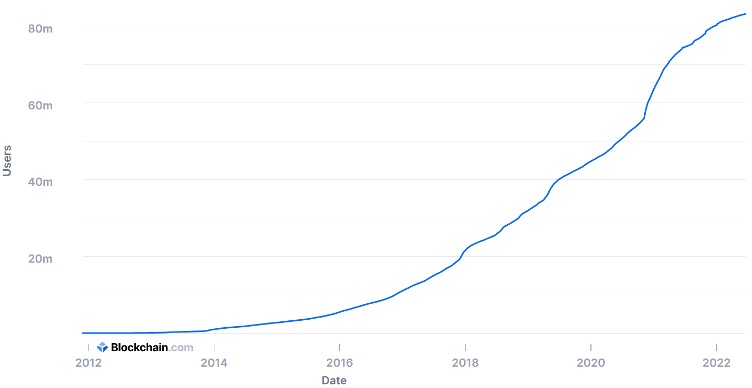

Bitcoin Halving—The Bitcoin Halving event takes place every 4 years and is integrated into the Bitcoin algorithm’s code to reduce the mining reward by 50% for completion of one block.77 The current reward rate is 6.25 Bitcoins per completed block which will be reduced to 3.125 Bitcoins per block in April of 2024. 78, 79 As a result, the price of Bitcoin has historically seen exponential price increases 6 to 12 months following the halving event. This is a result of the inflow of new Bitcoin into the ecosystem being constrained thus driving demand synergistically as widespread adoption continues as depicted with the increasing creation of unique wallet addresses on Blockchain.com in Figure 3.6 This demand-driven price increase is shown in Figure 2 with green vertical lines denoting Bitcoin halving events where price increase shortly follows. Miners will also require an increase in Bitcoin’s price to cover their operating costs on a case-by-case basis which is fundamental to keeping the Bitcoin network functional. Sensitivity will be conducted using the current block reward rate, the reward rate after the next Bitcoin halving event in April 2024, and the reward rate after the halving event in 2028.

After experimentally mining Bitcoin under the current block reward context, the Antminer S17e produces 0.0980 Bitcoin annually, rendering current economic conditions with operations unprofitable at -$930. The price of Bitcoin with the average annual electrical costs of $2,988 must be $30,490 to be at breakeven to incentivize miners to keep the network running. Post 2024 halving event with an assumed constant network difficulty, no miner hardware upgrades, and constant electrical cost rates, the reward will be reduced to 0.049 Bitcoin and will require a Bitcoin value of $60,980 to keep miners at breakeven incentivizing them to keep the network running. Post 2028 halving event with an assumed constant network difficulty, no miner hardware upgrades, and constant electrical cost rates, the reward will be reduced to 0.0245 Bitcoin and will require a $121,960 Bitcoin to keep miners at breakeven incentivizing them to keep the network running.

Figure 3. Total number of unique wallets created on Blockchain.com. Number of unique users is on the y-axis and time is on the x-axis.6

Experimental Hash Rate—The hash rate using Slushpool’s dashboard interface is shown in Figure 4. The nominal hash rate which is the total number of hashes generated by the Antminer is shown in purple.80 The scoring hash rate is depicted in yellow which is an average value of effective hashes that satisfies the pool’s hash criteria used for reward allocations.80 Slushpool’s ability to find and complete blocks to reward contributors are chance events that vary in frequency as denoted by the white diamonds on the base-line in Figure 4. The Antminer S17e takes approximately 15 minutes to reach full hashing capacity of 64 Th/s from the time of powering on. Once stabilizing around 64 Th/s, the nominal hash rate fluctuates frequently between 45 Th/s and 85 Th/s while the scoring hash rate fluctuates to a smaller degree between 58 Th/s and 73 Th/s.

Figure 4. Antminer S17e experimental Hash Rate in terahashes per second (Th/s) on Slushpool. Starting in the “off state” until turned on at time 22:30. Number of terahashes per second is on the y-axis and time in hours is on the x-axis. Scoring hash rate shown in yellow, nominal hash rate shown in purple, and found blocks denoted as white diamonds.

Experimental Electrical Consumption Metrics—The results for voltage, current, power, energy, frequency, and power factor were identical across the Antminer’s two power cables in separate 24-hour trials. The frequency remained constant at 60 Hz while voltage fluctuated within the range of 234 V (1 cable) (117 V for one line) and 244 V (1 cable) (122 V for one line) in each power cable for the duration of the experiment. During the powering-on period, which lasts between 5 and 30 minutes, the miner took 6 minutes to gradually reach peak current, power, and power factor at 13.84 A, 1,658 W, and 0.99 PF respectively, for one power cable. After 30-minutes, these measurements stabilized. Inside one power cable, the power factor became constant at 0.99 PF, the current fluctuates between 13.50 A and 13.82 A, and the power fluctuated between 1,618 W and 1,634 W. This equates to total current and power measurement ranges across both power cables of 27 A to 27.64 A and 3,236 W to 3,268 W respectively. The experimental energy drawn by one power cable was a cumulative measurement and calculated to be 39.08 kWh for a 24-hour period after recording the total energy drawn every hour, which is equivalent to a continuous power of 3,256 W for the whole miner. The total energy drawn by the Antminer S17e across both power cables is 78.16 kWh and constant over a 24-hour period.

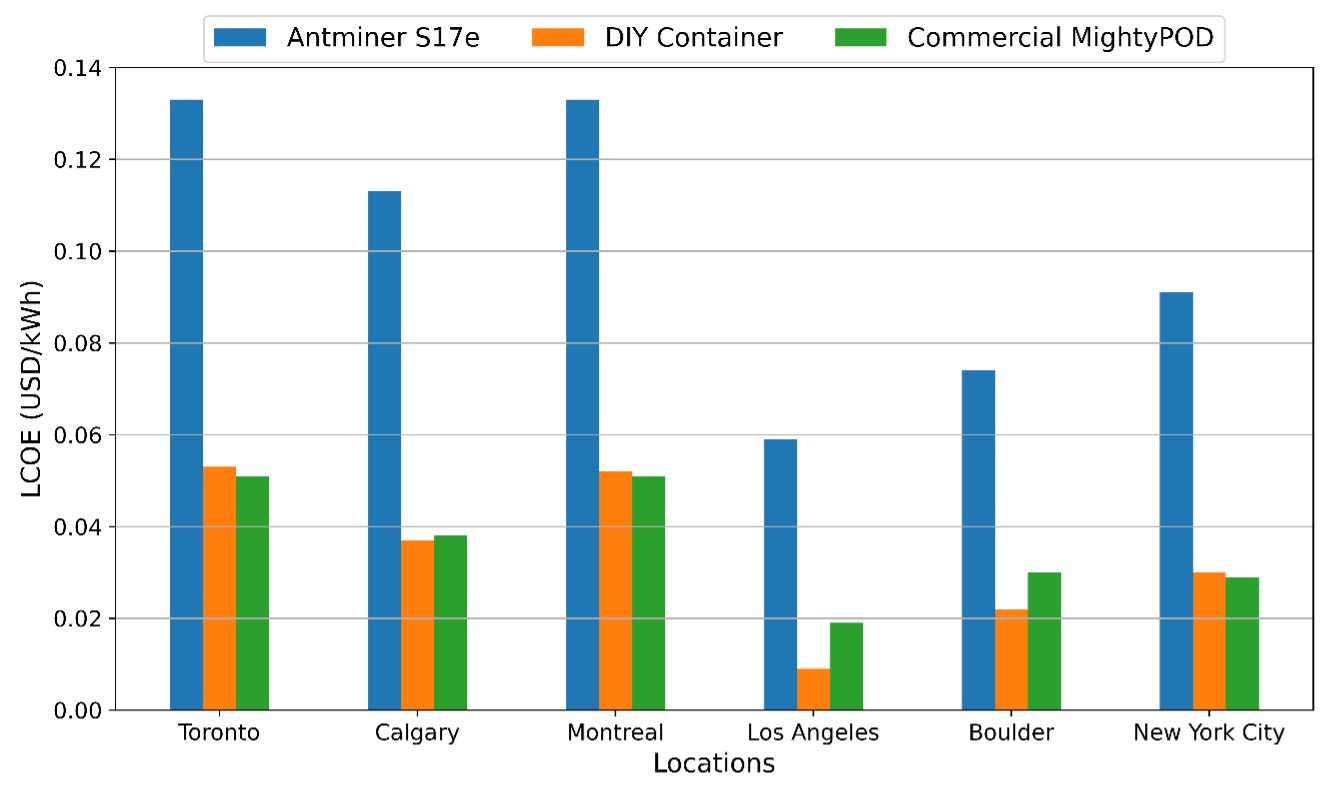

PV systems simulation results—The DC power required for the system in each location and the cost of the electricity (LCOE) are shown respectively in Table 4 and Figure 5. The cost of the electricity shown in Figure 5 will be used for the energy analysis using solar PV.

Table 4. Detailed LCOE Results (USD/kWh)

![]()

| Crypto Mining System Type | Antminer S17e | DIY Mining Container | Commercial MightyPOD Mining Container | ||

|---|---|---|---|---|---|

| Land Acquisition Type | No Land Acquisition | Dedicated PV Farm | Agrivoltaic Farmland | Dedicated PV Farm | Agrivoltaic Farmland |

| Toronto | 0.133 | 0.053 | 0.053 | 0.051 | 0.051 |

| Calgary | 0.113 | 0.037 | 0.037 | 0.038 | 0.038 |

| Montreal | 0.133 | 0.052 | 0.052 | 0.051 | 0.05 |

| Los Angeles | 0.059 | 0.009 | 0.0088 | 0.019 | 0.0184 |

| Boulder | 0.074 | 0.022 | 0.0219 | 0.03 | 0.0295 |

| New York City | 0.091 | 0.03 | 0.0298 | 0.029 | 0.0285 |

![]()

Figure 5. Levelized cost of electricity (USD/kWh) of solar PV required to power three different type of cryptocurrency mining operations in six different locations across North America.

Table 5. Net Capital Cost for the Three Systems at Each of the Six Locations

![]()

| Crypto Mining System Type | Antminer S17e | DIY Mining Container | Commercial MightyPOD Mining Container | ||

|---|---|---|---|---|---|

| Land Acquisition Type | No Land Acquisition | Dedicated PV Farm | Agrivoltaic Farmland | Dedicated PV Farm | Agrivoltaic Farmland |

| Toronto | 94,962 | 1,889,609 | 1,889,609 | 14,240,475 | 14,240,475 |

| Calgary | 80,682 | 1,319,161 | 1,319,161 | 10,610,550 | 10,610,550 |

| Montreal | 94,962 | 1,853,956 | 1,853,956 | 14,240,475 | 13,961,250 |

| Los Angeles | 42,126 | 320,877 | 313,746 | 5,305,275 | 5,137,740 |

| Boulder | 52,836 | 784,366 | 780,801 | 8,376,750 | 8,237,138 |

| New York City | 64,974 | 1,069,590 | 1,062,459 | 8,097,525 | 7,957,913 |

![]()

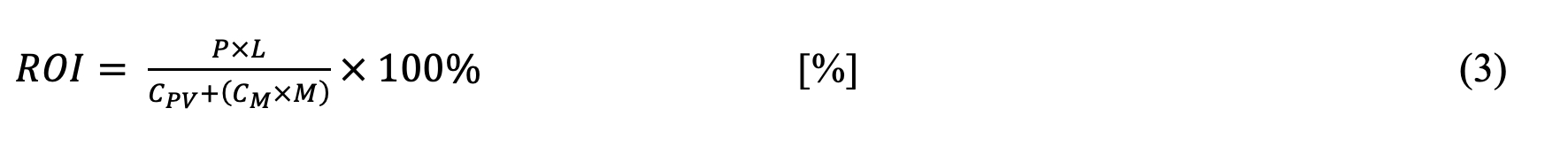

To analyze profitability with the calculated LCOE in six locations for three types of Antminer S17e mining operations, the mining network difficulty and medium Bitcoin price at the 0% Fibonacci logarithmic regression level of $35,731 will be assumed constant.46 The production of one Antminer S17e will be the calculated average of 0.0980 Bitcoin annually with constant network difficulty.46 Under a one-year time horizon, the individual Antminer S17e PV system scenario with no land acquisition will have an annual revenue of 0.0980 Bitcoin or $3,502 in all analyzed locations.46 Utilizing the LCOE values in Table 4, and the miner’s annual power requirement of 28,560 kWh, the annual net profit (P) is found using the following equation:

Where B is the annual Bitcoin production per miner, M is the number of miners, and p is the Bitcoin price, C is the LCOE per kWh in a location, l, and E is the annual energy requirements in kWh.

In Toronto, Calgary, Montreal, Los Angeles, Boulder, and New York City the net profit is -$297, $274, -$297, $1,817, $1,388, and $903, respectively. Utilizing the net capital cost from Table 5 and the $1,523 initial investment of the miner, the total cost over the 25-year duration of the PV system for Toronto, Calgary, Montreal, Los Angeles, Boulder, and New York City is $96,485, $82,205, $96,485, $43,649, $54,359, and $66,497, respectively, which considers the future value of money. The breakeven periods found through the division of this total cost by the constant revenue of $3,502 in each location measured in years occur at 23.5, 12.5, 15.5, and 19.0 for Calgary, Los Angeles, Boulder, and New York City, respectively. Toronto and Montreal do not experience breakeven due to annual losses of $297. The return on investment (ROI) for each venture over the 25-year lifespan of the PV system in each location is calculated using the following equation and summarized in Table 6.

where L is the lifetime of the PV (25 years), CPV is the net capital cost of the PV and CM is the capital cost of the miners.

Table 6. Return on Investment for the Three Systems at Each of the Six Locations

![]()

| Crypto Mining System Type | Antminer S17e | DIY Mining Container | Commercial MightyPOD Mining Container | ||

|---|---|---|---|---|---|

| Land Acquisition Type | No Land Acquisition | Dedicated PV Farm | Agrivoltaic Farmland | Dedicated PV Farm | Agrivoltaic Farmland |

| Toronto | -8% | 127% | 127% | 145% | 145% |

| Calgary | 8% | 219% | 219% | 224% | 224% |

| Montreal | -8% | 131% | 131% | 145% | 149% |

| Los Angeles | 104% | 1,022% | 1,040% | 513% | 513% |

| Boulder | 64% | 418% | 419% | 304% | 310% |

| New York City | 34% | 289% | 290% | 317% | 324% |

![]()

The annual profit for the DIY container with a dedicated PV farm for Toronto, Calgary, Montreal, Los Angeles, Boulder, and New York City are $99,498, $122,315, $100,924, $162,247, $143,707, and $132,298 respectively. Utilizing the net capital cost from Table 5 and the $76,150 initial investment of the 50 Antminer S17e miners, the total cost over the 25-year duration of the PV system for Toronto, Calgary, Montreal, Los Angeles, Boulder, and New York City is $1,965,759, $1,395,311, $1,930,106, $397,027, $860,516, and $1,145,740, respectively. With an annual revenue of 4.9 Bitcoin or $175,082, the corresponding breakeven periods measured in years occur at 11.2, 8.0, 11.0, 2.3, 4.9, and 6.5 respectively.

The annual profit for the DIY container with agrivoltaic farmland (strategic co-development of land for both PV electrical generation and agriculture) for Toronto, Calgary, Montreal, Los Angeles, Boulder, and New York City are $99,498, $122,315, $100,924, $162,532, $143,850, and $132,584 respectively. Utilizing the net capital cost from Table 5 and the $76,150 initial investment of the 50 Antminer S17e miners, the total cost over the 25-year duration of the PV system for Toronto, Calgary, Montreal, Los Angeles, Boulder, and New York City is $1,965,759, $1,395,311, $1,930,106, $389,896, $856,951, and $1,138,609, respectively. With an annual revenue of 4.9 Bitcoin or $175,082, the corresponding breakeven periods measured in years occur at 11.2, 8.0, 11.0, 2.2, 4.9, and 6.5 respectively.

The annual profit for the MightyPOD container with a dedicated PV farm for Toronto, Calgary, Montreal, Los Angeles, Boulder, and New York City are $859,049, $1,004,246, $859,049, $1,216,457, $1,093,598, and $1,104,767 respectively. Utilizing the net capital cost from Table 5 and the $621,384 initial investment of the 408 Antminer S17e miners, the total cost over the 25-year duration of the PV system for Toronto, Calgary, Montreal, Los Angeles, Boulder, and New York City is $14,861,859, $11,231,934, $14,861,859, $5,926,659, $8,998,134, and $8,718,909, respectively. With an annual revenue of 39.984 Bitcoin or $1,428,668, the corresponding breakeven periods measured in years occur at 10.4, 7.9, 10.4, 4.2, 6.3, and 6.1 respectively.

The annual profit for the MightyPOD container with agrivoltaic farmland for Toronto, Calgary, Montreal, Los Angeles, Boulder, and New York City are $859,049, $1,004,246, $870,218, $1,223,159, $1,099,183, and $1,110,352 respectively. Utilizing the net capital cost from Table 5 and the $621,384 initial investment of the 408 Antminer S17e miners, the total cost over the 25-year duration of the PV system for Toronto, Calgary, Montreal, Los Angeles, Boulder, and New York City is $14,861,859, $11,231,934, $14,582,634, $5,759,124, $8,858,522, and $8,579,297, respectively. With an annual revenue of 39.984 Bitcoin or $1,428,668 the corresponding breakeven periods measured in years occur at 10.4, 7.9, 10.2, 4.0, 6.2, and 6.0, respectively.

Conventional grid electricity was also evaluated for the miners operating in the same locations. Toronto’s rate is $0.10/kWh, 81 which leads to an annualized electricity cost of approximately $2,856. With the production of 0.098 BTC per year by one S17e, this operation would yield a net profit of $646. Calgary’s rate of $0.13/kWh creates an annualized electrical cost of $3,713 and net loss of $211 per year.81 Montreal’s rate of 0.057/kWh leads to a yearly electrical cost of $1,628 and an annual profit of $1,874.81 Los Angeles’s rate of $0.22/kWh creates an annualized electrical cost of $6,283 and a loss of $2,781 per year.82 Boulder’s rate of $0.14/kWh yields an annualized electrical cost of $3,998 and a net loss of $496 per year.83 New York’s rate of $0.19/kWh leads to an annualized electrical cost of $5,426 and a loss of $1,924 per year.84 Through this sensitivity analysis, Montreal is the desired location to operate as the lower electricity rate enables the highest profitability of $1,874 annually under an assumed $35,731 Bitcoin valuation and an Antminer S17e.

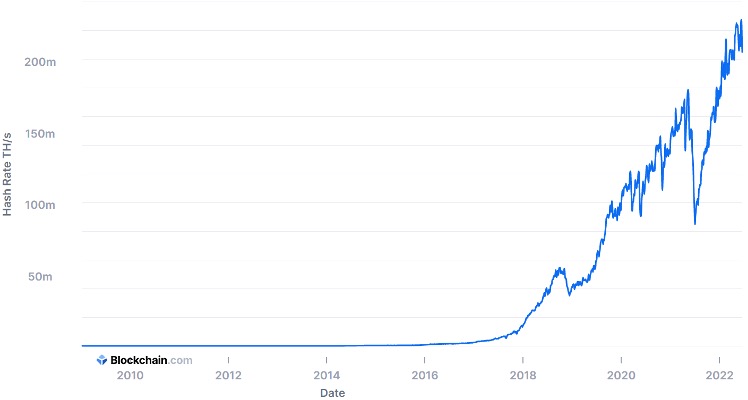

It is important to recognize the variability that exists within the assumptions made during the sensitivity analysis. It is highly unlikely the price of Bitcoin will remain constant throughout a one-year time horizon given its volatile price history (seen in Figure 1). It may increase or decrease in value making operations potentially profitable or unprofitable as a result.

It is also not feasible to assume a constant 0.098 BTC yearly reward from an Antminer S17e as the network difficulty shown in Figure 6 has consistently increased over time as new cryptocurrency miners are developed with higher hashing capabilities. This would result in a lower BTC reward allocation due to constant hashing capabilities of the S17e and decrease profitability. However, there is an argument to be made that as price decreases and mining becomes less profitable that the less-efficient miners will shut down operations to limit losses, thereby decreasing network difficulty as total network hashing will be reduced with fewer miners. Further work is needed in this area.

The assumption of constant network difficulty is unrealistic when considering the history of total hashrate TH/s measure by Blockchain.com as seen below (Figure 6).

The re-sale value of Antminer S17e hardware on the secondary market in the event of closing operations or upgrading equipment should also be considered when calculating net profit and loss for the venture’s duration. Mining hardware is constantly upgrading annually, and it should be noted that potential miners may opt to sell equipment to upgrade to increase profitability or recoup initial investment.

Current global economic conditions as of 26 June 2022 should also be considered when financially planning a Bitcoin mining venture as inflation remains at a 40-year high rate of 8.6% in the United States.85 All major indices and cryptocurrencies have experienced significant declines in value as a result which may persist with speculation of an impending recession in 2023 by two thirds of financial analysts. 86, 87 Under this economic climate, Bitcoin’s price may decline leading to unprofitability and greater annualized loses thereby extending the payback period of the initial investment of equipment. These are factors to consider for anyone considering cryptocurrency mining today.

The initial investment of the Bitcoin mining container by BitMG Inc. gives an accurate approximation of pricing for a large-scale modular operation. Rates for certain invoices and items may be variable depending on the service provider. Electrical engineering services provided by JADA Electric Inc. used to power the container for example, may vary depending on the hired provider. Quotes given by Quotecolo and Bit-Ram for the prefabricated commercial mining container are valid for 14 days and are subject to change beyond this period. This would affect the total initial investment and thus payback period for financial planning.

Figure 6. Total Hash Rate in terahashes per second on the Bitcoin network. Number of terahashes per second is on the y-axis and time is on the x-axis.88

There are also some details about the cooling of the miners that need more clarification. In calculating the total energy used for a mining setup of a data center more generally, the energy needed for cooling should be included.89 The miners need to operate at an appropriate ambient temperature to prevent the internal safety mechanism from shutting the miners off. Bitmain recommends that miners operate within an appropriate ambient temperature of 15–35 degrees Celsius.90 In isolation, the Antminer s17e is designed to function independently of cooling systems as it possesses a self-regulating design in which the heat exhaust is expelled from one side with the cool air intake coming from the opposite side, preventing re-uptake of heat exhaust. The miner is designed to avoid overheating by default if heat exhaust is adequately expelled. The pedestal fan is intended to aid in preventing heat exhaust re-uptake, not for cooling the hardware. Similarly, the mining containers in the study are designed to facilitate the miner’s original design through physical alignment at scale to exhaust the heat out of an opening on one side of the container and intaking ambient temperature from the opposite side. Assuming adequate design, an active refrigerant cooling system is not required if the ambient temperature remains below 35 degrees Celsius. The additional fans would be implemented to ensure adequate supplementation of air to the cool air intake of the miners and as an extra measure to prevent recycling of heat exhaust in hot ambient locations. The DIY container is capable of functioning independently of cooling systems as Antminer S17e miners are incapable of overheating in adequate ambient temperature ranges unless the heat exhaust above 35 degrees Celsius is recycled into the cool air intake. This holds true for the design of the commercial MightyPOD container as well. This setting is used for the feasibility analysis of using solar photovoltaics to power cryptocurrency miners in this study. Finally, the solar radiation collected by the container itself can impact the operating temperature and will be highly dependent on the material and color of material used and the setting upon which the container is placed. 91 Additional work is underway investigating the thermal dynamics of containerized miners for a better understanding of the waste heat and potential applications for it.92

The economic analysis of the three mining operations utilizing PV systems in six locations assumes the energy transfer with the grid is net metered and therefore not factored into profitability. The LCOE was calculated with consideration of the future value of money over 25 years and therefore accounts for this variability. Los Angeles provides the lowest LCOE for the three mining operations and under the two land use adjustment factors. This results in Los Angeles being the most attractive location to pursue a PV mining operation from an economic perspective due to consistently higher annual profits and shorter breakeven periods than all other locations in each scenario. According to this analysis, the optimal setting to use the PV system is with the DIY mining container on agrivoltaic farmland in Los Angeles as it provides the lowest breakeven period of 2.23 years and an annual profit of $162,532. The observation that Los Angeles was the most expensive location to operate within when using conventional electricity sources and becomes the most profitable when switching to PV systems indicates a substantial incentive for operators in the location to transition to PV systems.

PV, however, at the scale needed for cryptocurrency industry adoption will necessitate vast surface areas because of the dilute nature of solar radiation. 93, 94 This has the potential to create land use conflicts.95, 96 Fortunately, a substantial body of literature now exists showing it is possible to have large-scale PV development while protecting agricultural production using the innovation of agrivoltaics. 97 – 103 Using agrivoltaics, which can increase crop yields, is a promising means to obtain the surface area needed to power mining at low costs. 104–108 Future work is needed to determine the optimal ways to couple agrivoltaics and cryptocurrency mining. This study can be used as the foundation for future research into the feasibility of agrivoltaics and renewable solar energy sources more generally through understanding the necessary energy requirements of Bitcoin mining. Profitability calculations under various sensitivity scenarios allows for effective financial planning for those looking to pursue Bitcoin mining and for future research into the intricacies that constitute profitable Bitcoin mining. Future work may involve evaluating various debt financing options for equipment and operations to generate the highest ROI. Inspecting optimization strategies for the miner’s hashrate to maximize profitability and ROI with cooling techniques are also important areas of future work. Future work with the newest Antminers on the market, such as the S19, may make results with the PV system more generalizable and profitable.

Solar photovoltaic renewable energy offers the promise of long-term sustainability to the cryptocurrency mining industry. It has the potential to eliminate the industry’s reliance on non- renewable energy sources that destabilize the global climate and as a result global food supply. This study has experimentally obtained the capital investment and energy requirements of Bitcoin mining with an Antminer S17e at both small and commercial scales with various sensitivity approaches applied. The experimental consistency in energy consumption of 78.16 kWh per day for one Antminer S17e allows for future research to build upon this work by extrapolating the data to other projects. The capital cost for one Antminer S17e was $1,523, for the DIY mining container including the 50 Antminer S17e miners was $112,584, and the cost for the commercial MightyPOD container including 408 Antminer S17e miners was $827,384. Through integration of PV as the energy source for the three mining systems, operational feasibility was confirmed and an increase in profitability was observed without reliance on non- renewable sources of energy. The PV integration on an individual Antminer S17e in Los Angeles displayed the largest increase in profitability after registering an annual loss of $2,781 with conventional energy sources. The PV system enabled the Antminer to become profitable at $1,817 per year. The profitability and thus return on investment varied by location primarily because of the geographic distribution of solar flux. The ROI for Toronto and Montreal were both negative because of low-cost electricity. The ROI for Calgary was 8%, and the ROIs in the U.S. cities evaluated were substantial, ranging from 104% in Los Angeles, to 64% in Boulder, and to 34% in New York. Los Angeles was the most profitable location to convert to PV-based mining of Bitcoin because of the high electric costs on the grid and high annual solar fluxes. Although the study is based in North America regarding energy rates, climate, and energy laws, the analysis methodology is generalizable globally and grants the average business the knowledge to make an informed decision on whether to pursue this venture from a financial and environmental perspective.

This research was supported by the Thompson Endowment, Western University USRI, and Natural Sciences and Engineering Research Council of Canada.

MTM performed the experiments, financial analysis and wrote the first draft of the manuscript, KSH developed the PV model and performed the PV simulations, FH set up the mining experiments and validated the results, JMP conceived of the study, acquired funding and resources, and validated the analysis. All authors contributed to the revising and editing of the manuscript.

Author MTM owns Bitcoin mining company BitMG.

1 Nakamoto, S. “Bitcoin: A Peer-to-Peer Electronic Cash System.” (2008) (accessed 4 June 2022)

https://bitcoin.org/bitcoin.pdf.

2 Courtois, N. T., Grajek, M., Naik, R. “The Unreasonable Fundamental Incertitudes Behind Bitcoin Mining.” arXiv (accessed October 2013) https://doi.org/10.48550/arXiv.1310.7935.

3 DeVries, P. D. "An Analysis of Cryptocurrency, Bitcoin, and the Future." International Journal of Business Management and Commerce 1.2 1-9 (2016) https://ijbmcnet.com/images/Vol1No2/1.pdf.

4 Walton, A. J., Johnston, K. A. “Exploring Perceptions of Bitcoin Adoption: The South African Virtual Community Perspective.” Interdisciplinary Journal of Information, Knowledge, and Management 13 165-182 (2018) https://www.proquest.com/docview/2616626080.

5 Best, R. de. “Bitcoin Market Cap 2013-2022.” Statista (accessed 5 June 2022) https://www.statista.com/statistics/377382/bitcoin-market-capitalization/ .

6 “My-wallet-N-users.” Blockchain.com (accessed 5 June 2022) https://www.blockchain.com/charts/my-wallet-n-users.

7 Howarth, J. “How Many People Own Bitcoin? 95 Blockchain Statistics (2022).” Exploding Topics (accessed 5 June 2022) https://explodingtopics.com/blog/blockchain-stats#number-of-wallets.

8 For more on how Bitcoin functions, see: Ankalkoti, P., S. G. Santhosh. "A Relative Study on Bitcoin Mining." Imperial Journal of Interdisciplinary Research (IJIR) 3.5 1757-1761 (2017) https://www.researchgate.net/publication/318850089_A_Relative_Study_on_Bitcoin_M ining; Patrick. “What Is SHA-256 and How Is It Related to Bitcoin?” Mycryptopedia (accessed 5 June 2022) https://www.mycryptopedia.com/sha-256-related-bitcoin/; Houy, N. “The Bitcoin Mining Game.” Ledger 1 53–68 (2016) https://doi.org/10.5195/ledger.2016.13 ; Bag, S., Ruj, S., Sakurai, K. “Bitcoin Block Withholding Attack: Analysis and Mitigation” IEEE 12.8 1967-1978 https://doi.org/10.1109/TIFS.2016.2623588 ; Dimitri, N. “Bitcoin Mining as a Contest.” Ledger 2 31-37 (2017) https://doi.org/10.5195/ledger.2017.96 ; Kroll, A. J, Davey, C. I., Felten, W. E. "The Economics of Bitcoin Mining, or Bitcoin in the Presence of Sdversaries." Proceedings of WEIS 2013.11 (2013) http://www.infosecon.net/workshop/downloads/2013/pdf/The_Economics_of_Bitcoin_Mining,_or_Bitcoin_in_the_Presence_of_Adversaries.pdf ; Bonneau, J., Clark, J., & Goldfeder, S. “On Bitcoin as a Public Randomness Source.” Cryptology ePrint Archive (2015) https://ia.cr/2015/1015; Bhaskar, N. D., Chuen, D. L. K. “Bitcoin Mining Technology.” Handbook of digital currency Academic Press 45-65 (2015) https://doi.org/10.1016/B978-0-12-802117-0.00003-5.

9 Romiti, M., Judmayer, A., Zamyatin, A., Haslhofer, B. “A Deep Dive into Bitcoin Mining Pools: An Empirical Analysis of Mining Shares.” arXiv (2019) https://doi.org/10.48550/arXiv.1905.05999.

10 Liu, Y., Chen, X., Zhang, L., Tang, C., Kang, H. "An Intelligent Strategy to Gain Profit for Bitcoin Mining Pools," 10th International Symposium on Computational Intelligence and Design (ISCID) 427-430 (2017) https://doi.org/10.1109/ISCID.2017.184.

11 Taylor, M. B. "The Evolution of Bitcoin Hardware," Computer 50.9 58-66 (2017) https://doi.org/10.1109/MC.2017.3571056.

12 Wang, L., Liu, Y. “Exploring Miner Evolution in Bitcoin Network.” In Passive and Active Measurement 290-302 (2015) https://doi.org/10.1007/978-3-319-15509-8_22.

13 Delgado-Mohatar, O., Felis-Rota, M., Fernández-Herraiz, C. “The Bitcoin Mining Breakdown: Is Mining Still Profitable?” Economics Letters 184 108492 (2019) https://doi.org/10.1016/j.econlet.2019

.05.044.

14 Egiyi, M. A., Ofoegbu, G. N. "Cryptocurrency and Climate Change: An Overview." International Journal of Mechanical Engineering and Technology (IJMET) 11.3 15-22 (2020) http://eprints.gouni.edu.ng/2575/.

15 Mora, C., et al. “Bitcoin Emissions Alone Could Push Global Warming Above 2°C.” Nature Climate Change 8 931–933 (2018) https://doi.org/10.1038/s41558-018-0321-8.

16 Mohsin, K. "Cryptocurrency & Its Impact on Environment." International Journal of Cryptocurrency Re- search (2021) https://dx.doi.org/10.2139/ssrn.3846774.

17 Badea, L., Mungiu-Pupӑzan, M. C. "The Economic and Environmental Impact of Bitcoin." IEEE Access 9 48091-48104 (2021) https://doi.org/10.1109/ACCESS.2021.3068636.

18 Goodkind, A. L., Jones, B. A., & Berrens, R. P. "Cryptodamages: Monetary Value Estimates of the Air Pollution and Human Health Impacts of Cryptocurrency Mining." Energy Research & Social Science 59 101281 (2020) https://doi.org/10.1016/j.erss.2019.101281.

19 Krause, M. J., Tolaymat, T. “Quantification of Energy and Carbon Costs for Mining Cryptocurrencies.” Nature Sustainability 1 711-718 (2018) https://doi.org/10.1038/s41893-018-0152-7.

20 Jamet, S., Corfee-Morlot, J. “Assessing the Impacts of Climate Change: A Literature Review.” OECD Economics Department Working Papers (April 2009) https://doi.org/10.1787/224864018517.

21 Kummu, M., Heino, M., Taka, M., Varis, O., Viviroli, D. “Climate Change Risks Pushing One-Third of Global Food Production Outside the Safe Climatic Space.” One Earth 4 720–729 (2021) https://doi.org/10.1016/j.oneear.2021.04.017.

22 Tong, S., Ebi, K. “Preventing and Mitigating Health Risks of Climate Change.” Environmental. Re- search 174 9–13 (2019) https://doi.org/10.1016/j.envres.2019.04.012.

23 Stern, N. The Economics of Climate Change: The Stern Review. Cambridge: Cambridge University Press 23-40 (2007).

24 Rhodes, J. “Is Bitcoin Inherently Bad for the Environment?” Forbes (accessed 5 June 2022) https://www.forbes.com/sites/joshuarhodes/2021/10/08/is-bitcoin-inherently-bad-for-the-environment.

25 Mamatkulov, M., Birsel, R. "Uzbekistan Legalises Solar-Powered Crypto Mining." Reuters (accessed 6 June 2022) https://www.reuters.com/business/finance/uzbekistan-legalises-solar-powered-crypto-mining-2022-05-04/.

26 Bitir-Istrate, I., Gheorghiu, C., Gheorghiu, M. "The Transition Towards an Environmental Sustainability for Cryptocurrency Mining." E3S Web of Conferences 294 03004 (2021) https://doi.org/10.1051/e3sconf/202129403004.

27 Nikzad, A., Mehregan, M. "Techno-Economic, and Environmental Evaluations of a Novel Cogeneration System Based on Solar Energy and Cryptocurrency Mining." Solar Energy 232 409-420 (2022) https://doi.org/10.1016/j.solener.2022.01.014.

28 Eid, B., Islam, M. R., Shah, R., Nahid, A. A., Kouzani, A. Z., Mahmud, M. P. "Enhanced Profitability of Photovoltaic Plants By Utilizing Cryptocurrency-Based Mining Load." IEEE Transactions on Applied Superconductivity 31.8 1-5 (2021) https://doi.org/10.1109/TASC.2021.3096503.

29 Hunt, T. "Solar-Powered Bitcoin Mining Could Be a Very Profitable Business Model" Greentech Media (2017) (accessed 12 June 2022) https://www.greentechmedia.com/articles/read/solar-powered-bitcoin-mining-could-be-a-very-profitable-business-model.

30 Horasia, C., ur Rehman, N., Yap, M., Rehman, A. "Sustainable Cryptocurrency Mining." Asia-Pacific Solar Research Conference (December 2021) https://www.researchgate.net/profile/Naveed-Rehman-3/publication/357168567_Sustainable_Cryptocurrency_Mining/links/61bfc5c363bbd93242a6a669/Sustainable-Cryptocurrency-Mining.pdf.

31 Rehman, N., Yap, M., Afzal, M., Rehman, A., Horasia, C. "Feasibility Model for Solar-Powered Cryptocurrency Mining Setups." Southern Institute of Technology Journal of Applied Research 2021 1 (2021) https://www.researchgate.net/publication/355082671_Feasibility_Model_For_Solar-Powered_Cryptocurrency_Mining_Setups.

32 Náñez Alonso, S. L., Jorge-Vázquez, J., Echarte Fernández, M. Á., Reier Forradellas, R. F. "Cryptocurrency Mining from an Economic and Environmental Perspective: Analysis of the Most and Least Sustainable Countries." Energies 14.14 4254 (2021) https://doi.org/10.3390/en14144254.

33 Zhai, S. "Self-Sustained Bitcoin Mining: A Profitable and Sustainable Business Model." European Journal of Economics and Management Sciences 2 25-31 (2019) (accessed 13 June 2022) https://cyber-leninka.ru/article/n/self-sustained-bitcoin-mining-a-profitable-and-sustainable-business-model/pdf.

34 Pearce, J. M. “Photovoltaics—A Path to Sustainable Futures.” Futures 34.7 663-674 (2002) https://doi.org/10.1016/S0016-3287(02)00008-3.

35 Schelly, C., Lee, D., Matz, E., Pearce, J. M. “Applying a Relationally and Socially Embedded Decision Framework to Solar Photovoltaic Adoption: A Conceptual Exploration.” Sustainability 13.2 711 (2021) http://dx.doi.org/10.3390/su13020711.

36 Branker, K., Pathak, M. J. M., Pearce, J. M. “A Review of Solar Photovoltaic Levelized Cost of Electricity.” Renewable and Sustainable Energy Reviews 15.9 4470-4482 (2011) https://doi.org/10.1016/j.rser.2011.07.104.

37 Evans, S. “Solar Is Now 'Cheapest Electricity in History', Confirms IEA: Carbon Brief.” Carbon Brief (accessed 5 June 2022) https://www.carbonbrief.org/solar-is-now-cheapest-electricity-in-history-confirms-iea/.

38 Singh, R., Alapatt, G. F., Bedi, G. “Why and How Photovoltaics Will Provide Cheapest Electricity in the 21st Century.” Facta Universitatis, Series: Electronics and Energetics 27.2 275-298 (2014) http://dx.doi.org/10.2298/FUEE1402275S.

39 Bruce, J. "How Many Solar Panels Do I Need To Mine Bitcoin?". DIY Solar Shack (August 2021) (accessed 14 June 2022) https://diysolarshack.com/how-many-solar-panels-to-mine-bitcoin/.

40 Peters, J. "Block and Blockstream Are Partnering with Tesla on an Off-Grid, Solar-Powered Bitcoin Mine in Texas." The Verge (2022) (accessed 14 June 2022) https://www.theverge.com/2022/4/8/23016553/block-blockstream-tesla-solar-bitcoin-mine-texas.

41 Reiff, N. "Is Solar-Powered Cryptocurrency Mining the Next Big Thing?" Investopedia (2019) (accessed 13 June 2022) https://www.investopedia.com/news/solarpowered-cryptocurrency-mining-next-big-thing/.

42 Browning, K. "Solar Powered Bitcoin Mining: Does Solar Mining Crypto Work?" Climatebiz (accessed 6 June 2022) https://climatebiz.com/solar-powered-bitcoin-mining/.

43 Winton, B. "Solar + Battery + Bitcoin Mining" Medium (2021) (accessed 12 June 2022) https://wintonark.medium.com/bitcoin-mining-impact-on-renewable-uptake-fc91c5aa9be0.

44 Govender, L. "Cryptocurrency Mining Using Renewable Energy: An Eco-Innovative Business Model." Arcada University of Applied Science (June 2019) https://urn.fi/URN:NBN:fi:amk-2019060214064.

45 Purnama, F., Irwansyah, M. B. A., Usagawa, T. "Is Zero Electricity Cost Cryptocurrency Mining Possible? Solar Power Bank on Single Board Computers.” The 14th International Student Conference on Ad- vanced Science and Technology (ICAST) (November 2019) https://www.researchgate.net/publication/337621315_Is_Zero_Electricity_Cost_Cryptocurrency_Mining_Possible_Solar_Power_Bank_on_Single_Board_Computers.

46 “Bitmain Antminer S17e (64Th) profitability.” ASIC Miner Value (accessed 15 June 2022) https://www.asicminervalue.com/miners/bitmain/antminer-s17e-64th.

47 “Bit-Ram Has Crypto Mining Container for Sale and With The Fastest Turnaround Times in the Industry.” BIT RAM (accessed 1 July 2022) https://bit-ram.ca/.

48 “IPTV Bundles – Ignite TV and Internet Bundles” Rogers.com (accessed 14 June 2022) https://www.rogers.com/promotions/tv-internet.

49 “Slush Pool | by Braiins.” Braiins | Slush Pool (accessed 15 June 2022) https://slushpool.com/en/home/.

50 “Reward System Specification,” Braiins | Slush Pool (accessed 26 June 2022) https://help.slushpool.com/en/support/solutions/articles/77000426280-reward-system-specification.

51 “For Living Tilt-Head Oscillating Pedestal/Stand Fan w/Adjustable Height, 3-Speed, Assorted, 16-in.” Canadian Tire https://www.canadiantire.ca/en/pdp/for-living-tilt-head-oscillating-pedestal-stand-fan-w-adjustable-height-3-speed-assorted-16-in-0435649p.html#plp.

52 “AntMiner S9 ~13.5TH/s @ 0.098W/GH 16nm ASIC Bitcoin Miner with Power Supply and Cord : Amazon.ca: Electronics.” Amazon (accessed 16 June 2022) https://www.amazon.ca/AntMiner-S9-13-5TH-0-098W-Bitcoin-Supply/dp/B01GFEOV0O/.

53 “BITMAIN Shop, Bitcoin Miner S19 XP” Bitmain Technologies (accessed 16 June 2022) https://shop.bitmain.com/product/detail?pid=00020220210152002039CHAR8f2i0636.

54 “AC Digital Multi-Function Meter” Amazon (accessed 12 August 2022) https://images-na.ssl-images-amazon.com/images/I/91ruFFpzaxL.pdf.

55 “Amazon.com: NEMA 6-20P to C13 Power Cord - 15A/250V, 14/3 AWG - Iron Box # IBX-4936 (5 ft, Build) : Electronics.” Amazon (accessed 16 June 2022) https://www.amazon.com/NEMA-6-20P-C13-Power-Cord/dp/B004WJNVH4.

56 “Buy Containers.” Northern Container Sales (accessed 16 June 2022) https://northerncontainersales.ca/buy-shipping-containers/.

57 “225 kVA 600 Volt to 208Y/120 Volt Three phase Isolation Transformer BA225J-M/Z3.” Canada Transformers (accessed 16 June 2022) https://canadatransformers.com/225-kva-isolation-transformer-ba225j-m-z3.html.

58 JADA Electric Inc., BitMG Inc., SESCO. Personal Communication (2018).

59 “24 in. Industrial Oscillating Pedestal Fan.” Princess Auto (accessed 16 June 2022) https://www.princessauto.com/en/24-in-industrial-oscillating-pedestal-fan/product/PA0008912321.

60 “Husky 77-inch W x 78-inch H x 24-inch D 4-Shelf Heavy Duty Industrial Welded Steel Garage.” The Home Depot Canada (accessed 16 June 2022) https://www.homedepot.ca/product/husky-77-inch-w-x-78-inch-h-x-24-inch-d-4-shelf-heavy-duty-industrial-welded-steel-garage-storage-rack-shelving-unit-in-black/1001621278.

61 “D-Link Ethernet Switch, 24 Port Gigabit Easy Smart Managed Network Internet Desktop or Rack Mountable (DGS-1100-24V2), Black : Amazon.ca: Electronics.” Amazon (accessed 16 June 2022) https://www.amazon.ca/D-Link-Ethernet-Internet-Mountable-DGS-1100-24V2/dp/B0876G6ZC2/.

62 “StarTech.com Cat5e Ethernet Cable10 ft - Blue - Patch Cable - Snagless Cat5e Cable - Network Cable - Ethernet Cord - Cat 5e Cable - 10ft : Amazon.ca: Electronics.” Amazon (accessed 16 June 2022) https://www.amazon.ca/StarTech-com-RJ45PATCH10-Snagless-Patch-10-Feet/dp/B0002AFYJ0/.

63 “WM-14 Panel Mount 277/480V or 347/600V Multi-function Meter,” Intellimeter Canada Inc. (accessed 16 June 2022) https://www.intellimeter.com/products/wm-14-panel-moount-277-460v-or-347-600v-multi-function-meter.

64 “SIEMENS CANADA ID364 200A 600V 3-Poles 3-Fuse Fusible Industrial Duty Switch.” Gescan(accessed 16 June 2022) https://www.gescan.com/products/20-power-distribution.

65 “SIEMENS CANADA EQ442QJ200 200Amp 42-CCT 3-Phase Siemens Combo Panel With Main Breaker.” Gescan (accessed 16 June 2022) https://www.gescan.com/products/20-power-distribution/06-load-centers/09-three-phase-main-breaker-load-centers.

66 “Bitcoin Miner Container Prices - Bitcoin Mining Containers For Sale” QuoteColo (accessed 1 July 2022) https://www.quotecolo.com/bitcoin-miner-container/.

67 Spiegal, B. Quotecolo. Personal Communication (29 June 2022).

68 Ramlall, I. Fibonacci Retracements. Bingley: Emerald Group Publishing Limited 165-176 (2016) https://doi.org/10.1108/978-1-78635-634-520161013.

69 “TradingView – Track All Markets,” TradingView (accessed 17 June 2022) https://www.tradingview.com/.

70 Freeman, J. M., et al. “System Advisor Model (SAM) General Description (Version 2017.9.5).” National Renewable Energy Lab (2018) https://doi.org/10.2172/1440404.

71 Milosavljević, D. D., Kevkić, T. S., Jovanović, S. J. “Review And Validation of Photovoltaic Solar Simulation Tools/Software Based on Case Study.” Open Physics 20, 431–451 (2022) https://doi.org/10.1515/phys-2022-0042.

72 “Solar Panel Incentives and Rebates in Canada.” Renogy Canada (accessed 10 August 2022) https://ca.renogy.com/blog/solar-panel-incentives-and-rebates-in-canada/.

73 “MODULES – CSI Solar – Global.” CanadianSolar (accessed 2 August 2022) https://www.csisolar.com/module/.

74 “Value Per Acre of Farm Land and Buildings at July 1.” Statistics Canada (accessed 5 August 2022) https://doi.org/10.25318/3210004701-eng.

75 “Farmland Value.” USDA Economic Research Service (accessed 5 August 2022) https://www.ers.usda.gov/topics/farm-economy/land-use-land-value-tenure/farmland-value/.

76 “Documenting a Decade of Cost Declines for PV Systems.” National Renewable Energy Laboratory (5 August 2022) https://www.nrel.gov/news/program/2021/documenting-a-decade-of-cost-declines-for-pv-systems.html.

77 Tran, K. C., Graves, S., Hussey, M. “What is the Bitcoin Halving? How Bitcoin’s Supply is Limited.” Decrypt (2022) (accessed 16 June 2022) https://decrypt.co/resources/what-is-the-bitcoin-halving.

78 “Bitcoin Halving – How Does the Halving Cycle Work and Why Does It Matter?” Cointelegraph (accessed 15 June 2022) https://cointelegraph.com/bitcoin-for-beginners/bitcoin-halving-how-does-the-halving-cycle-work-and-why-does-it-matter.

79 “#1 Bitcoin Halving Countdown & Date ETA” BTC Clock (accessed 15 June 2022) https://www.buybitcoinworldwide.com/bitcoin-clock/.

80 “Hashrate Specification.” Braiins | Slush Pool (accessed 24 June 2022) https://help.slushpool.com/en/support/solutions/articles/77000422780-hashrate-specification.

81 Urban, R. “Electricity Prices in Canada 2021.” energyhub.org (accessed 2 August 2022) https://www.energyhub.org/electricity-prices/.

82 “Average Energy Prices, Los Angeles-Long Beach-Anaheim – December 2021” U.S. Bureau of Labor Statistics (accessed 5 August 2022) https://www.bls.gov/regions/west/news-release/2022/ averageenergyprices_losangeles_20220113.htm.

83 “Cost of Electricity in Boulder, CO” EnergySage (accessed 5 August 2022) https://www.energysage.com/local-data/electricity-cost/co/boulder-county/boulder/.

84 “Cost of Electricity in New York” EnergySage (accessed 5 August 2022) https://www.energysage.com/local-data/electricity-cost/ny/.

85 The Associated Press. “America’s Inflation Problem Is Getting Worse, Not Better, as Rate Rises to 8.6%.” CBC News (accessed 26 June 2022) https://www.cbc.ca/news/business/us-inflation-1.6484205.

86 Pound, J. “Dow Dives 800 Points, S&P 500 Posts Worst Week Since January After Inflation Hits 40-Year High.” CNBC (accessed 26 June 2022) https://www.cnbc.com/2022/06/09/stock-market-news-open-to-close.html.

87 “Over Two Thirds of Economists Think a Recession Will Hit The U.S. Next Year.” Fortune (accessed 26 June 2022) https://fortune.com/2022/06/13/recession-economists-survey-2023-inflation-interest-rates/.

88 “Hash-rate.” Blockchain.com (accessed 17 June 2022) https://www.blockchain.com/charts/hash-rate.

89 Sawyer, Richard. "Calculating Total Power Requirements for Data Centers." White Paper, American Power Conversion 562 (2004). https://www.se.com/us/en/download/document/SPD_VAVR-5TDTEF_EN/.

90 Admin. “Antminer S17 is Temper-mental, as are S19, S9, T17, T9, L3+.” MinerDaily.com (accessed 22 November 2022) https://minerdaily.com/2021/antminer-s17-is-temper-mental-as-are-s19-s9-t17-t9-l3/.

91 de la Flor, Francisco José Sánchez, et al. "Solar Radiation Calculation Methodology for Building Exterior Surfaces." Solar Energy 79.5, 513-522 (2005) https://doi.org/10.1016/j.solener.2004.12.007.

92 Asgari, N., McDonald, M. T., Pearce, J. M., “Energy Modeling and Techno-economic Feasibility Analysis of Greenhouses for Tomato Cultivation Utilizing the Waste Heat of Cryptocurrency Miners.” Energies 16.3 1331 (2023) https://doi.org/10.3390/en16031331.

93 Calvert, K., Pearce, J. M., Mabee, W. E. “Toward Renewable Energy Geo-Information Infrastructures: Applications of Giscience and Remote Sensing that Build Institutional Capacity.” Renewable Sustainable Energy Reviews 18 416–429 (2013) https://doi.org/10.1016/j.rser.2012.10.024.

94 Calvert, K., Mabee, W. “More Solar Farms or More Bioenergy Crops? Mapping and Assessing Potential Land-Use Conflicts Among Renewable Energy Technologies in Eastern Ontario, Canada.” Applied Geography 56 209–221 (2015) https://doi.org/10.1016/j.apgeog.2014.11.028.

95 Dias, L., Gouveia, J. P., Lourenço, P., Seixas, J. “Interplay between the Potential of Photovoltaic Systems and Agricultural Land Use.” Land Use Policy 81 725–735 (2019) https://doi.org/10.1016/j.landusepol.2018.11.036.

96 Nonhebel, S. “Renewable Energy and Food Supply: Will There Be Enough Land?” Renewable Sustainable Energy Reviews 9 191–201 (2005) https://doi.org/10.1016/j.rser.2004.02.003.

97 Dupraz, C., Marrou, H., Talbot, G., Dufour, L., Nogier, A., Ferard, Y. “Combining Solar Photovoltaic Panels and Food Crops for Optimising Land Use: Towards New Agrivoltaic Schemes.” Renewable Energy 36 2725–2732 (2011) https://doi.org/10.1016/j.renene.2011.03.005.

98 Dinesh, H., Pearce, J. M. “The Potential of Agrivoltaic Systems.” Renewable and Sustainable Energy Reviews 54 299–308 (2016) https://doi.org/10.1016/j.rser.2015.10.024.

99 Mavani, D. D., Chauhan, P. M., Joshi, V. “Beauty of Agrivoltaic System Regarding Double Utilization of Same Piece of Land for Generation of Electricity & Food Production.” International Journal of Scientific & Engineering Research 10.6 118–148 (2019) (accessed 15 June 2022) https://www.ijser.org/researchpaper/Beauty-of-Agrivoltaic-System-regarding-double-utilization-of-same-piece-of-land-for-Generation-of-Electricity-Food-Production.pdf.

100 Pascaris, A. S., Schelly, C., Pearce, J. M. “A First Investigation of Agriculture Sector Perspectives on the Opportunities and Barriers for Agrivoltaics.” Agronomy 10.12 1885 (2020) https://doi.org/10.3390/agronomy10121885.

101 Santra, P., Pande, P. C., Kumar, S., Mishra, D., Singh, R. K. “Agri-Voltaics or Solar Farming—The Concept of Integrating Solar PV Based Electricity Generation and Crop Production in a Single Land use System.” International Journal of Renewable Energy Research 7.2 694–699 (2017) (accessed 15 June 2022) https://elk.adalidda.com/2017/07/5582-23376-1-PB.pdf.

102 Pascaris, A. S., Schelly, C., Burnham, L., Pearce, J. M. “Integrating Solar Energy with Agriculture: Industry Perspectives on the Market, Community, and Socio-Political Dimensions of Agrivoltaics.” Energy Research & Social Science 75 102023 (2021) https://doi.org/10.1016/j.erss.2021.102023.

103 Guerin, T. F. “Impacts and Opportunities from Large-Scale Solar Photovoltaic (Pv) Electricity Generation on Agricultural Production.” Environmental Quality Management 28 7–14 (2019) https://doi.org/10.1002/tqem.21629.

104 Marrou, H., Wery, J., Dufour, L., Dupraz, C. “Productivity and Radiation Use Efficiency of Lettuces Grown in the Partial Shade of Photovoltaic Panels.” European Journal of Agronomy 44 54–66 (2013) https://doi.org/10.1016/j.eja.2012.08.003.

105 Valle, B., et al. “Increasing the Total Productivity of a Land by Combining Mobile Photovoltaic Panels and Food Crops.” Applied Energy 206 1495–1507 (2017) https://doi.org/10.1016/j.apenergy.2017.09.113.

106 Barron-Gafford, G.A., et al. “Agrivoltaics Provide Mutual Benefits across the Food–Energy–Water Nexus in Drylands.” Nature Sustainability 2 848–855 (2019) https://doi.org/10.1038/s41893-019-0364-5.

107 Hudelson, T., Lieth, J. H. “Crop Production in Partial Shade of Solar Photovoltaic Panels on Trackers.” AIP Conference Proceedings 2361 080001 (2021) https://doi.org/10.1063/5.0055174.

108 Sekiyama, T., Nagashima, A. “Solar Sharing for Both Food and Clean Energy Production: Performance of Agrivoltaic Systems for Corn, a Typical Shade-Intolerant Crop.” Environments 6 65 (2019) https://doi.org/10.3390/environments6060065.